Driving Value: 2015 Automotive M&A Insights

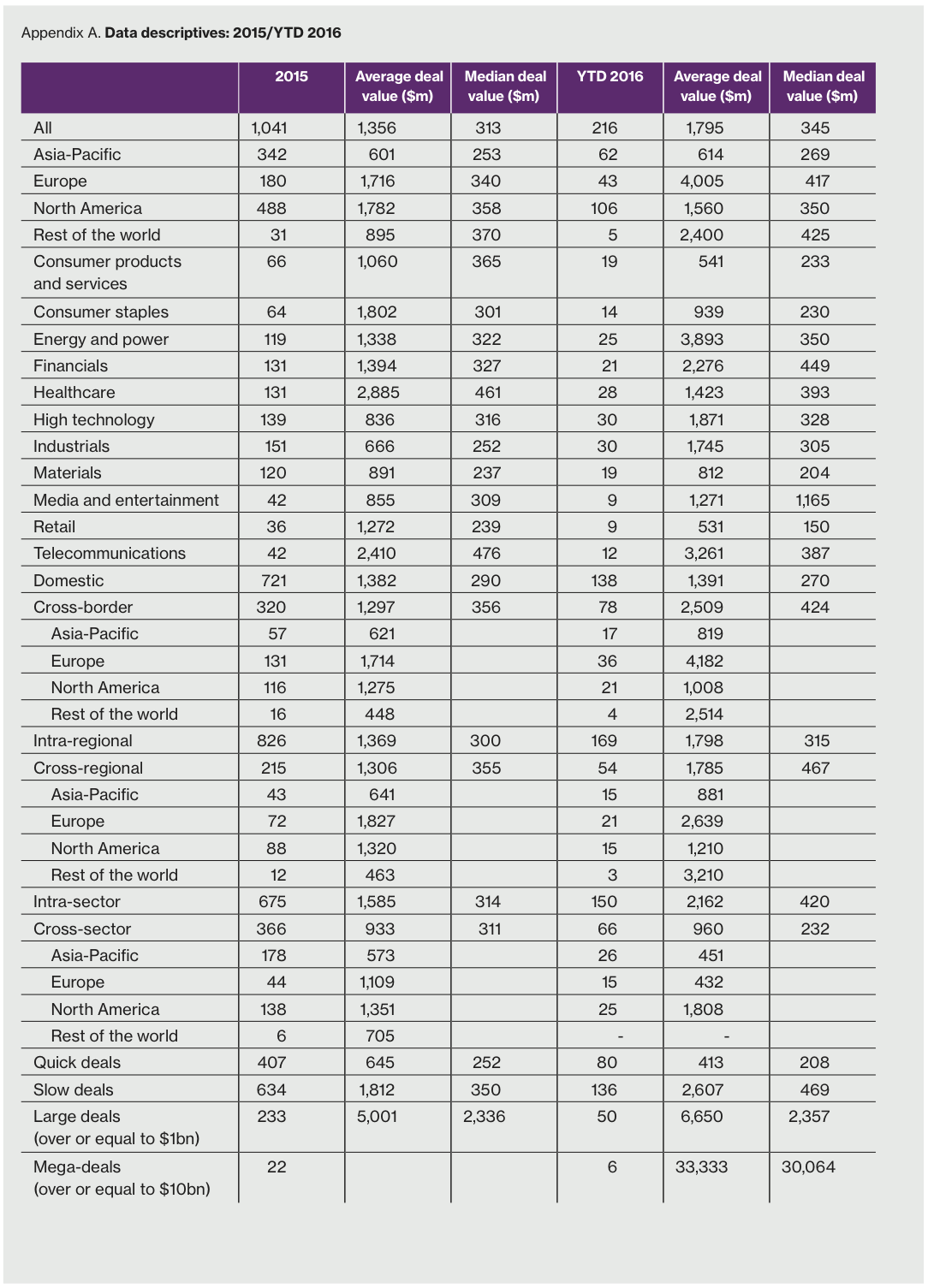

By Jeff Zaleskiand Christopher Becker– PricewaterhouseCoopers Year in review 2015 – 365 days, 591 deals, $62.1 billion total aggregate disclosed value Overview Automotive M&A deal volume for 2015 was up 9 percent, further extending gains made in 2014. With 591 deals, the industry saw its highest volume of deals transacted since 2011. • Global market conditions across all industries are … Read more