Reflections On A Gravity-Defying Year For Insurance M&A

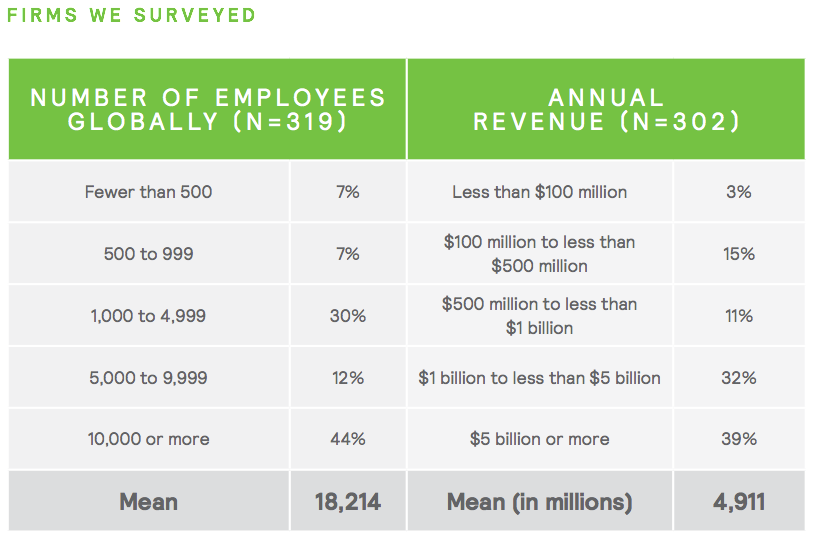

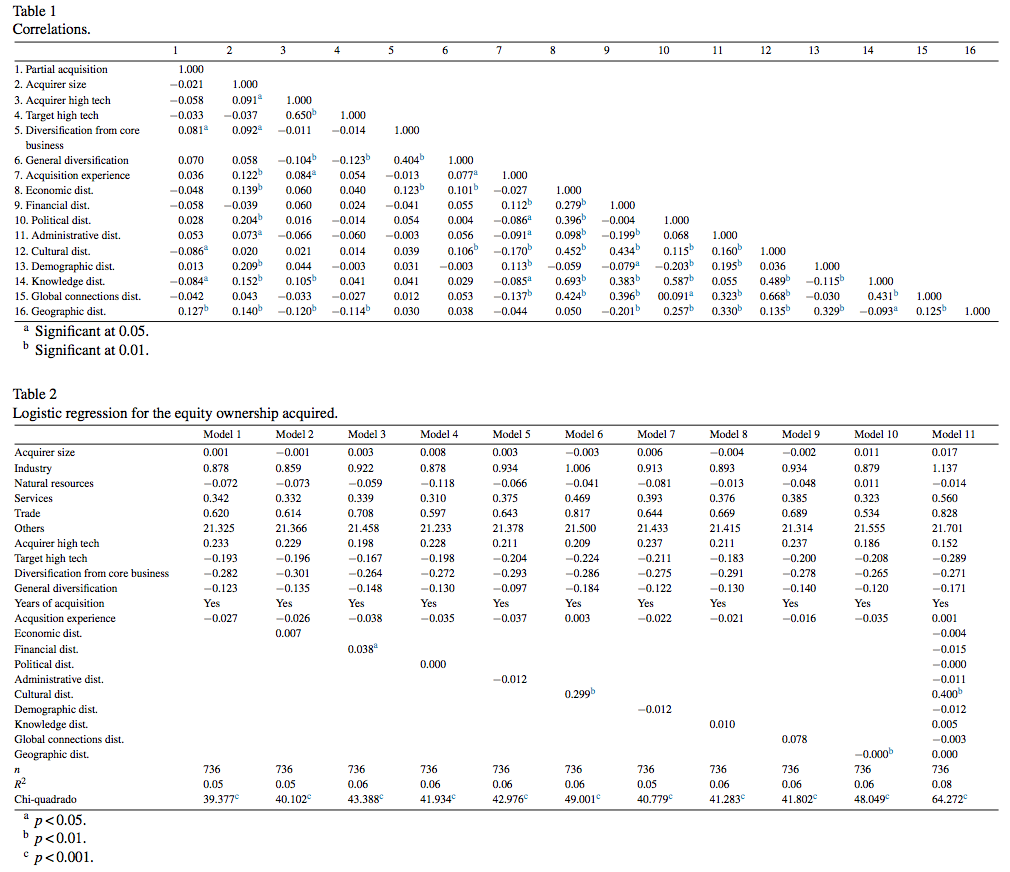

Dizzying Activity Marked 2015 By Jack Gibson, Fergal O’Shea, Andy Staudt – Willis Towers Watson Insurance was one of a number of business sectors to enjoy a banner year for merger and acquisition (M&A) activity in 2015. Willis Towers Watson’s latest M&A study, a joint effort with Mergermarket, analyzes the drivers in the surge in insurance deals and the priorities for … Read more