Comparative Analysis Of Mergers And Acquisitions In The New Member States Of European Union

by Elsevier Ltd.

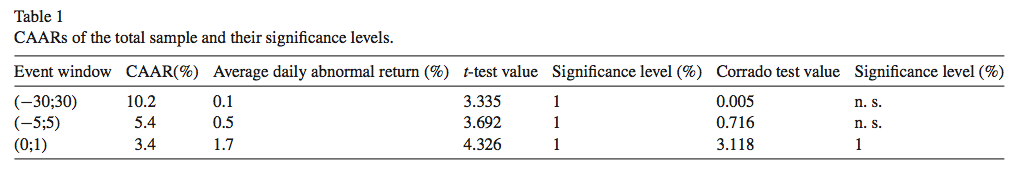

Mergers and acquisitions in the new member states of European Union (EU-10) are investigated in the study. The author concentrates on mergers and acquisitions value creation issue in the region. Event study methodology is employed to investigate the scientific problem of value generation as a consequence of analysed transactions. […] Read more