Effective Management Of Change During Merger And Acquisition

by Elsevier Ltd.

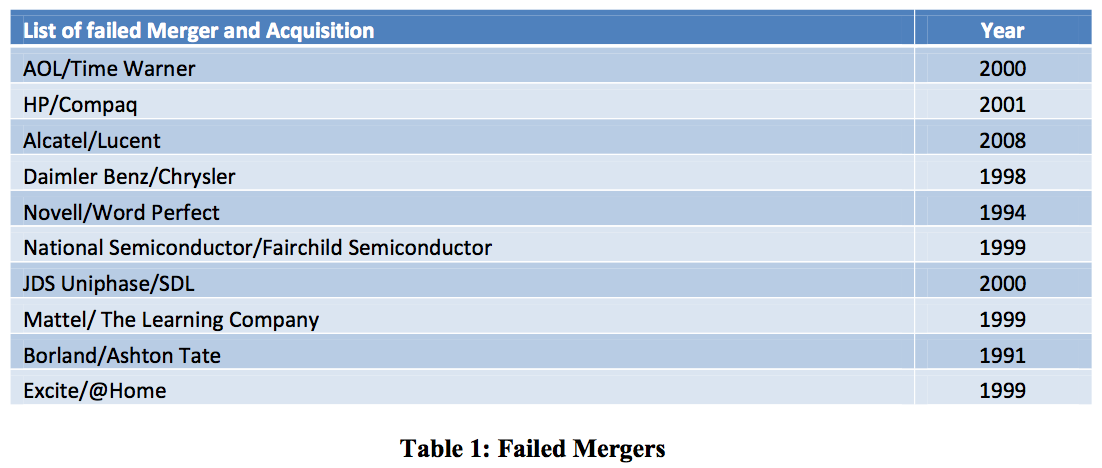

The on-going dance of merger and acquisition happening every week is hard to miss. But it has been found that most mergers and acquisition fail because of poor handling of change management. Change is the only thing that will never change so let’s learn to adopt by change management. This publication will analyse all the factors that lead to change. […] Read more