Operational Due Diligence: Investment Management And Funds

by KPMG

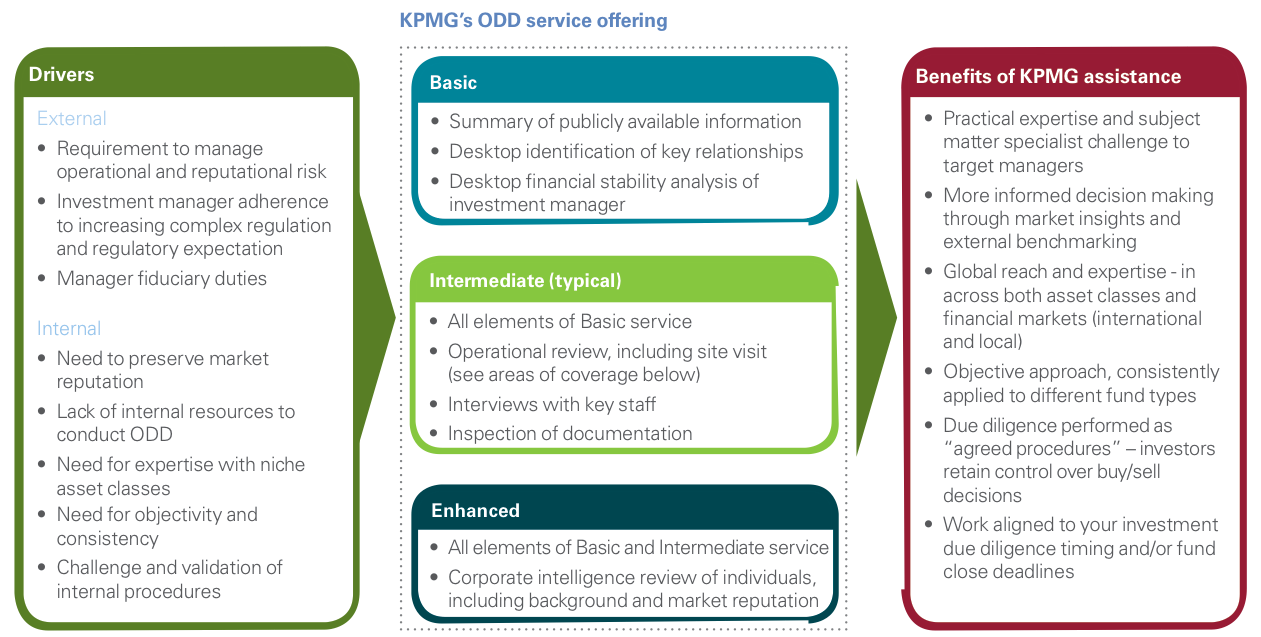

Operational due diligence (ODD) over investment managers has never been more critical. Recent scandals such as Madoff and Weavering have served to underline the growing importance of ODD in the minds of investors. Adding in other factors such as an increasingly complex regulatory environment and the investors’ search for the alpha generating, operationally sound investment managers becomes increasingly difficult. […] Read more