M&A Beyond Borders: Opportunities And Risks

by Marsh, Mercer, Kroll

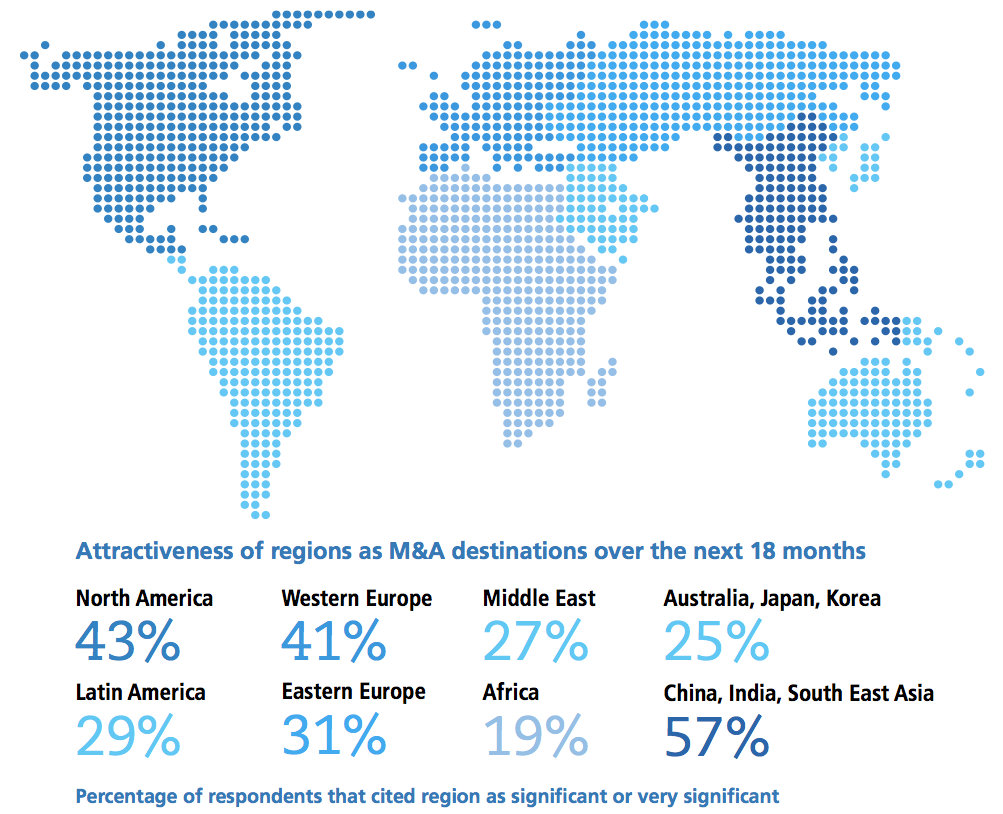

Emerging market corporations are now more confident in their pursuit of M&A. Chinese, Indian and Russian companies have been prolific in venturing outside their domestic markets to do deals, demonstrating that they are well-managed, efficient and globally competitive. Many of them have recently had initial public offerings on stock exchanges – not so much to raise capital as to demonstrate greater transparency, dispel perceptions of reputational issues and effectively pave the way for future M&A deals. […] Read more