- M&A News

M&A News: Global M&A Deals Week of April 14 to 20, 2025

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

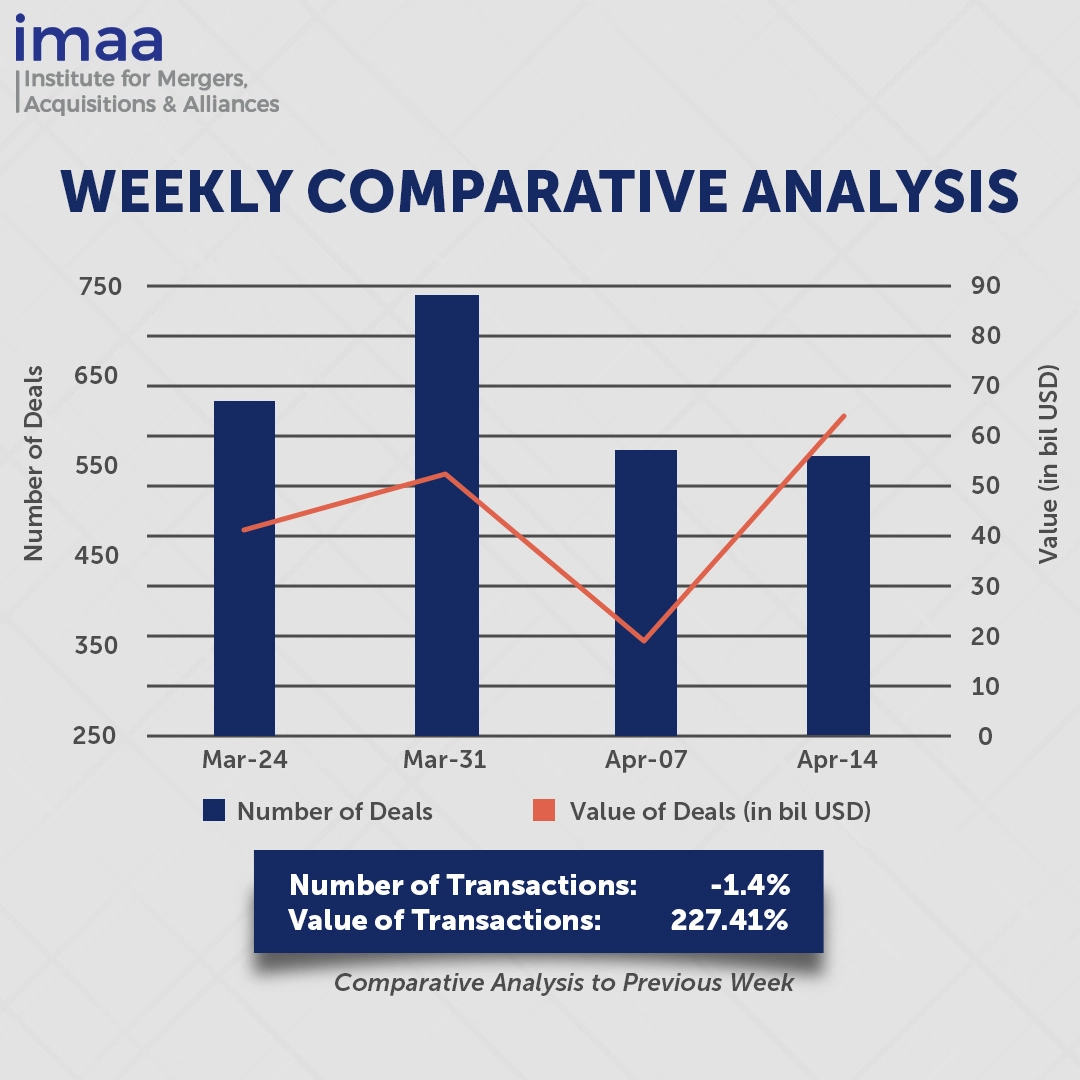

The mergers and acquisitions (M&A) market regained momentum during the week of April 14 to April 20, recording 565 announced deals with a total value of USD 63.39 billion. Of these transactions, 13 surpassed the USD 500 million threshold, contributing USD 55.16 billion and accounting for 87% of the total deal value for the week.

At the forefront of this week’s dealmaking was Global Payments’ planned acquisition of Worldpay for USD 24.25 billion—a move that reflects its strategy to focus on merchant services and strengthen its position among large corporate clients in a competitive payments landscape. Global Payments is acquiring Worldpay from GTCR and Fidelity National Information Services (FIS), while concurrently divesting its Issuer Solutions business to FIS for USD 13.5 billion. These transactions are expected to streamline Global Payments’ operations and reinforce its role as a dedicated commerce solutions provider for merchants worldwide. Meanwhile, FIS will sharpen its focus on serving financial institutions. The restructuring marks a pivotal shift for both companies, which rank among the world’s leading digital payments processors.

Compared to the previous week, the number of deals saw a slight decline of 1%, decreasing from 573 to 565. In contrast, total deal value surged by 227%, climbing from USD 19.63 billion to USD 63.93 billion, largely driven by a surge in high-value transactions during the period.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of April 14 to 20, 2025 in detail:

Deal No. 1: Global Payments Inc. to Acquire Worldpay, LLC for USD 24.25 Billion

Deal No. 2: Fidelity National Information Services, Inc. to Acquire Issuer Solutions business of Global Payments Inc. for USD 13.50 Billion

Deal No. 3: KKR & Co. Inc. to Acquire OSTTRA Group Ltd for USD 3.10 Billion

Deal No. 4: Adani Ports and Special Economic Zone Limited to Acquire Abbot Point Port Holdings Pte. Ltd. for USD 2.54 Billion

Deal No. 5: Kodiak Robotics, Inc. to Acquire Ares Acquisition Corporation II for USD 2.50 Billion

Deal No. 1:

Global Payments Inc. to Acquire Worldpay, LLC for USD 24.25 Billion

Global Payments is acquiring rival Worldpay in a landmark USD 24.25 billion transaction from private equity firm GTCR and fintech company FIS. The deal significantly enhances Global Payments’ position as a comprehensive commerce solutions provider, expanding its capabilities across the full merchant spectrum and deepening its presence in high-growth geographies and verticals.

Worldpay is a global payment processor known for its strong foothold in the enterprise and ecommerce sectors, offering a wide range of solutions to merchants worldwide. Combined, the two companies bring together complementary payments, software, and commerce enablement offerings, with a global footprint spanning over 175 countries. The merged entity will serve more than 6 million customers, process approximately 94 billion transactions annually, and handle around USD 3.7 trillion in payment volume.

The acquisition streamlines Global Payments’ business model, sharpening its focus as a dedicated commerce solutions provider. It enhances its ability to serve enterprise and ecommerce clients, expands embedded and integrated payment solutions for software and platform partners, and strengthens its small business portfolio with offerings like Genius POS.

The deal is expected to be modestly accretive in the first-year post-closing and deliver mid- to high-single-digit accretion in subsequent years. It is also projected to generate approximately USD 600 million in annual run-rate cost synergies within three years.

As part of the transaction, GTCR will receive 59% of the consideration in cash and 41% in stock. Upon completion, GTCR will hold shares that represent 15% of Global Payments’ outstanding shares, marking a significant stake in the newly formed entity.

The transaction is expected to close in the first half of 2026. Morgan Stanley & Co. LLC served as financial advisor to GTCR, while Wells Fargo advised Worldpay.

Deal No. 2:

Fidelity National Information Services, Inc. to Acquire Issuer Solutions business of Global Payments Inc. for USD 13.50 Billion

In a major three-way transaction, U.S.-based fintech company FIS has agreed to acquire Global Payments’ Issuer Solutions business for USD 13.5 billion. This acquisition further solidifies FIS’ position as a global fintech powerhouse, with a strong focus on serving large financial institutions.

At the same time, FIS has finalized a deal to sell its ownership stake in Worldpay to Global Payments for USD 6.6 billion in pre-tax value, marking the completion of a strategic restructuring of its business portfolio.

Issuer Solutions, recognized as a global leader in credit processing, operates in over 75 countries, processing more than 40 billion transactions annually. The business boasts strong relationships with over 170 financial institutions and corporations, positioning FIS to tap into a significant global issuer market valued at USD 28 billion, including a highly attractive USD 15 billion opportunity within the U.S.

The acquisition will enhance FIS’ existing debit processing capabilities by integrating Issuer Solutions’ extensive credit processing expertise, creating a more comprehensive offering within the banking and capital markets sector.

To finance the acquisition, FIS will leverage USD 8 billion in new debt along with the proceeds from selling its minority stake in Worldpay. The deal is expected to close in the first half of 2026.

Deal No. 3:

KKR & Co. Inc. to Acquire OSTTRA Group Ltd for USD 3.10 Billion

S&P Global and CME Group have reached an agreement to sell OSTTRA, a leading provider of post-trade solutions for the global over-the-counter (OTC) market, to KKR in a deal valued at USD 3.1 billion.

OSTTRA was created as a joint venture between CME Group and S&P Global, offering a wide range of critical post-trade services across multiple asset classes, including interest rates, foreign exchange (FX), credit, and equity.

The company delivers end-to-end connectivity and workflow solutions to a diverse array of market participants, such as banks, broker-dealers, and asset managers. These services cover the full trade lifecycle, from trade processing and management to optimization, solidifying OSTTRA’s role as a key player in global financial infrastructure.

Under the terms of the agreement, the current management team of OSTTRA, led by co-chief executives Guy Rowcliffe and John Stewart, will continue in their roles, ensuring continuity and leadership throughout the transition.

KKR’s investment will primarily come from its North American private equity strategy, and the firm plans to accelerate OSTTRA’s growth by increasing investments in technology and enhancing its post-trade solutions platform.

The transaction is anticipated to close in the second half of 2025. Barclays served as the financial advisor to S&P Global, Citi to CME Group, and Goldman Sachs & Co. LLC to KKR.

Deal No. 4:

Adani Ports and Special Economic Zone Limited to Acquire Abbot Point Port Holdings Pte. Ltd. for USD 2.54 Billion

Adani Ports and Special Economic Zone (APSEZ) is set to acquire Abbot Point Port Holdings, the owner of the North Queensland Export Terminal (NQXT), for AUD 4 billion (USD 2.54 billion) as part of its continued efforts to broaden its global footprint.

The NQXT, located in Queensland, Australia, is a key coal export facility with an annual handling capacity of 50 million tonnes. It primarily serves the Bowen and Galilee Basins, making it a crucial asset in Australia’s coal export industry. The terminal is operated under a long-term lease held by the Queensland Government through North Queensland Bulk Ports, which extends until 2110.

Notably, NQXT is recognized for its strong environmental, social, and governance (ESG) practices, maintaining a low environmental impact, a diverse workforce, and a strong commitment to local suppliers, with 50% of its operational spending directed to regional businesses.

For APSEZ, this acquisition is a significant milestone in its international expansion. As India’s largest integrated ports and logistics company, Adani Ports has been extending its presence globally, with operations already in Israel, Sri Lanka, and Tanzania. This acquisition will enable APSEZ to access new export markets and secure long-term contracts, aligning with its goal to handle 1 billion tonnes annually by 2030.

The deal is subject to approvals from regulatory bodies, including the Reserve Bank of India (RBI), shareholders, and Australia’s Foreign Investment Review Board. It is expected to close within the next two quarters.

Deal No. 5:

Kodiak Robotics, Inc. to Acquire Ares Acquisition Corporation II for USD 2.50 Billion

Kodiak Robotics plans to become a publicly traded company through a merger with Ares Acquisition Corporation II, a special purpose acquisition company (SPAC), placing the company’s pre-money equity valuation at USD 2.5 billion.

Established in 2018, Kodiak Robotics is a trailblazer in autonomous trucking, focusing on self-driving technology for long-haul freight transport. Its Kodiak Driver system provides scalable, real-world solutions that improve both safety and efficiency in freight logistics. Combining cutting-edge AI software with adaptable hardware, Kodiak has achieved significant milestones, including the commercial deployment of autonomous trucks and securing high-profile contracts, including with the U.S. Department of Defense. Kodiak is at the forefront of transforming the future of autonomous trucking.

By partnering with AACT and gaining access to public markets, Kodiak aims to accelerate its growth strategy, expand its network of partnerships, increase its customer base, and enhance its solutions across both the commercial trucking and public sectors, capitalizing on a global market opportunity valued at over USD 4 trillion.

The merger is expected to bring approximately USD 551 million in cash from Ares Acquisition Corporation II’s trust account, assuming no redemptions of existing shares.

Upon completion of the transaction, anticipated in the second half of 2025, Kodiak will be listed on the U.S. stock exchange under the name Kodiak AI, trading under the ticker symbols KDK and KDK WS, subject to approval from the relevant exchange.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of April 14 to 20, 2025. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter