- M&A News

M&A News: Global M&A Deals Week of April 21 to 27, 2025

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

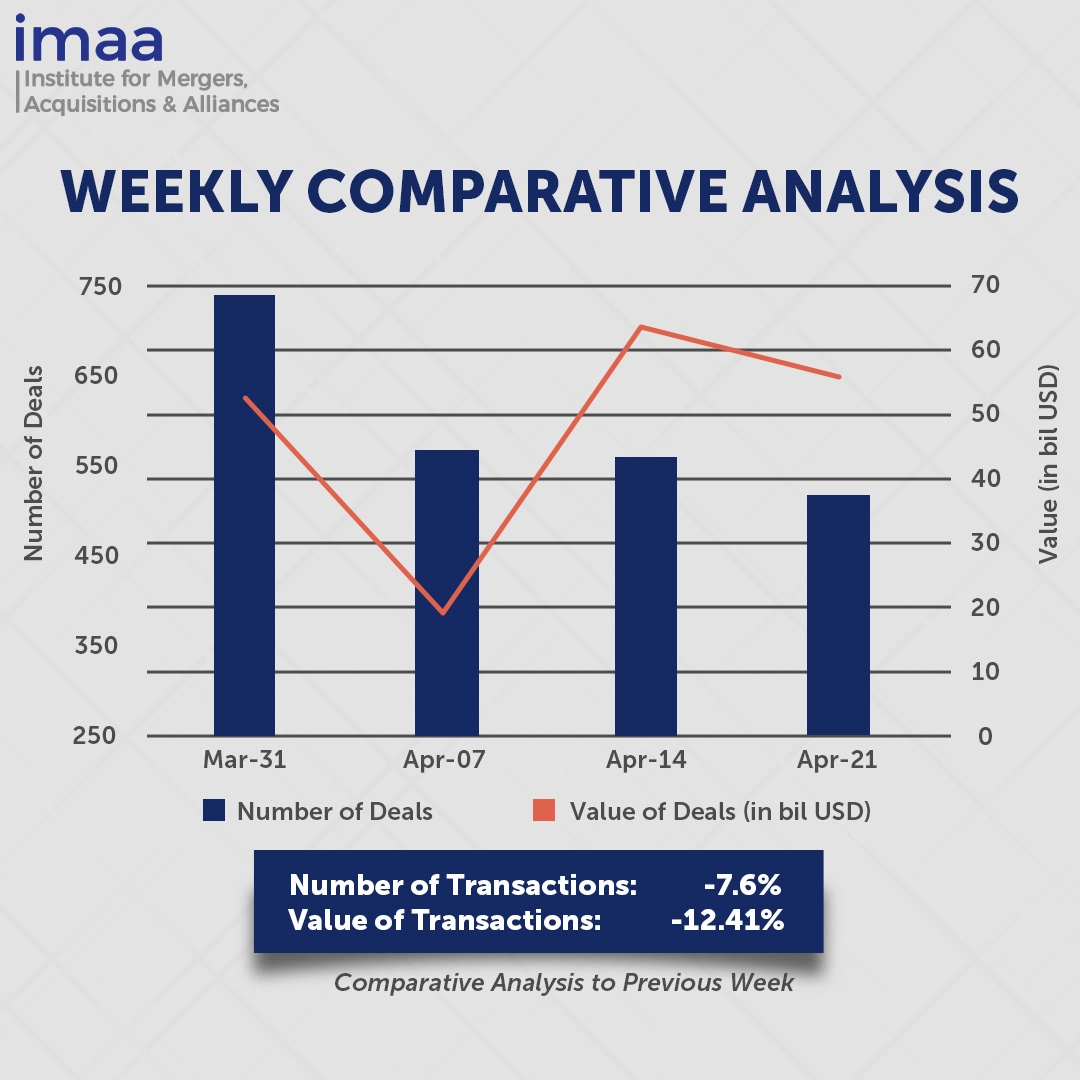

For the week of April 21 to April 27, the mergers and acquisitions (M&A) market saw a total of 522 transactions, with a combined deal value of USD 55.53 billion. Among these, 18 deals exceeded the USD 500 million mark, collectively accounting for USD 49.15 billion, or 89% of the total deal value for the week.

The most notable deal of the period was Thoma Bravo’s acquisition of Boeing’s Digital Aviation Solutions business for USD 10.55 billion in cash. This transaction includes Boeing’s Jeppesen, ForeFlight, AerData, and OzRunways assets. This sale is part of Boeing’s strategy to streamline operations, reduce costs, and raise capital amid ongoing financial challenges. The Digital Aviation Solutions unit offers a wide range of technology solutions aimed at enhancing flight operations, navigation, and planning for various aviation sectors, including commercial airlines, private aviation, and defense. The deal drew interest from several private equity firms and aerospace suppliers, with Thoma Bravo ultimately outbidding competitors like Advent and Verita. With a strong track record in investing in technology and software, Thoma Bravo is poised to expand its portfolio in the aviation digital solutions space.

On a week-on-week comparison, deal volume declined by 8%, dropping from 565 to 522 deals, while total deal value saw a 12.4% decrease, falling from USD 63.39 billion to USD 55.53 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of April 21 to 27, 2025 in detail:

Deal No. 1: Thoma Bravo, L.P. to Acquire Digital Aviation Solutions of The Boeing Company for USD 10.55 Billion

Deal No. 2: Helvetia Holding AG to Acquire Baloise Holding AG for USD 10.40 Billion

Deal No. 3: Baker Tilly International Limited to Acquire Moss Adams LLP for USD 7.00 Billion

Deal No. 4: DoorDash, Inc. to Acquire Deliveroo plc for USD 3.60 Billion

Deal No. 5: Columbia Banking System, Inc. to Acquire Pacific Premier Bancorp, Inc. for USD 2.00 Billion

Deal No. 1:

Thoma Bravo, L.P. to Acquire Digital Aviation Solutions of The Boeing Company for USD 10.55 Billion

Boeing is divesting its Digital Aviation Solutions business to the software investment firm Thoma Bravo in an all-cash transaction valued at USD 10.55 billion. This business encompasses key assets, including Jeppesen, ForeFlight, AerData, and OzRunways.

The Digital Aviation Solutions unit offers a range of digital tools and services for aviation operations. These assets include Jeppesen, a provider of navigation charts and flight planning services for pilots and airlines; ForeFlight, an advanced flight-planning and navigation app used for route optimization, weather tracking, and flight management; AerData, which specializes in digital solutions for aircraft leasing, maintenance, and asset management; and OzRunways, an Australia-based provider that assists pilots with flight planning, briefings, and navigation.

Over recent years, the business has experienced significant growth and development, gaining strong momentum in the market.

While Boeing will part with its Digital Aviation Solutions unit, it will retain core digital capabilities that leverage aircraft and fleet-specific data, providing maintenance, diagnostics, and repair services to both commercial and defense customers.

The deal is expected to be finalized by the end of 2025. Citi is serving as Boeing’s exclusive financial advisor for this transaction.

Deal No. 2:

Helvetia Holding AG to Acquire Baloise Holding AG for USD 10.40 Billion

Helvetia and Baloise are merging to form Switzerland’s second-largest insurance group. Helvetia will acquire Baloise in a transaction valued at USD 10.4 billion (CHF 8.4 billion).

The newly formed entity, Helvetia Baloise Holding, will rank among Europe’s top ten insurers, with a combined business volume of CHF 20 billion (USD 24.69 billion). This merger of equals will feature an equal distribution of senior executives and board members.

This union will create a major composite insurance group in Switzerland and Europe, employing over 22,000 individuals. The merged group will generate CHF 8.6 billion in gross premiums from its Life business and CHF 11.5 billion from its Non-Life business. Beyond existing cost optimization efforts, the merger is projected to deliver annual pre-tax synergies of around CHF 350 million, excluding policyholder participation.

This strategic move will enhance the long-term competitiveness and resilience of both companies, solidifying their position in both local and international insurance markets while creating substantial value for customers, partners, employees, shareholders, and the broader public.

Upon completion, expected in the fourth quarter of 2025, the combined group will be 53% owned by Helvetia shareholders and 47% by Baloise investors.

Deal No. 3:

Baker Tilly International Limited to Acquire Moss Adams LLP for USD 7.00 Billion

In a strategic move set to reshape the landscape of advisory and accounting services for the middle market, Baker Tilly will merge with Moss Adams in a deal valued at USD 7 billion.

Moss Adams, a prominent U.S.-based firm, is recognized for its expertise in audit, tax, and consulting services across various industries. The firm is known for its deep sector-specific knowledge, which helps clients foster growth, mitigate risks, and improve performance. On the other hand, Baker Tilly, a global network of independent accounting and consulting firms, operates in over 140 countries. It provides a comprehensive range of services, including audit, tax, and advisory, helping businesses of all sizes overcome challenges and reach their strategic objectives.

This merger is set to strengthen the firms’ industry expertise, expand their global presence, and solidify their position in private equity investments, paving the way for sustained growth and innovation. By combining their complementary strengths and a mutual dedication to client success, Baker Tilly and Moss Adams will merge under the Baker Tilly name, establishing themselves as the sixth-largest accounting firm in the U.S. This positions the firm to better support middle-market businesses as they navigate an increasingly complex business landscape.

As part of this deal, private equity firm Hellman & Friedman (H&F), an existing investor in Baker Tilly, will contribute an additional strategic investment. Valeas Capital Partners (Valeas), a current shareholder, will also increase its stake in the newly formed firm.

The combined entity is projected to generate approximately USD 6 billion in annual revenue by 2030, a significant growth from the over USD 3 billion they collectively reported in 2024. The firm will employ around 11,500 people, including 600 partners from Baker Tilly and 403 from Moss Adams.

The merger is expected to close in June. Simpson Thacher & Bartlett LLP and Vedder Price PC advised Baker Tilly, while Deutsche Bank Securities Inc. served as financial advisor and Dechert LLP provided legal counsel to Moss Adams.

Deal No. 4:

DoorDash, Inc. to Acquire Deliveroo plc for USD 3.60 Billion

DoorDash has proposed acquiring UK-based food delivery company Deliveroo for USD 3.6 billion, underscoring a growing trend of consolidation within the food delivery sector.

Founded in 2013, Deliveroo operates as an online platform connecting customers with local restaurants, enabling food orders for delivery via its app or website. The company is present in several countries, offering a wide variety of cuisines while providing restaurants and delivery drivers an effective way to expand their customer base.

Both DoorDash and Deliveroo have been diversifying their services, moving beyond traditional restaurant delivery to include groceries, convenience items, and innovative business models aimed at accelerating growth and profitability.

With a commanding two-thirds share of the U.S. restaurant delivery market, DoorDash is keen to extend its reach internationally. Acquiring Deliveroo would allow it to tap into the UK market and key urban centers across Europe, extending its reach into 10 new regions where it currently has no presence.

Deliveroo’s board has reviewed DoorDash’s proposal and is likely to recommend it to shareholders, pending agreement on the final terms. DoorDash is required to submit a firm offer by May 23.

Deal No. 5:

Columbia Banking System, Inc. to Acquire Pacific Premier Bancorp, Inc. for USD 2.00 Billion

Columbia Banking System is acquiring Pacific Premier Bank in an all-stock transaction valued at USD 2 billion.

Pacific Premier Bank, which operates across several Western states including California, Arizona, Nevada, Oregon, and Washington, provides financial services to small and middle-market businesses, professionals, and consumers. Its offerings include business and personal banking, lending solutions such as commercial and SBA loans, treasury management, and digital banking.

Following the acquisition, Columbia Banking System will merge Pacific Premier with its subsidiary, Umpqua Bank, and plans to rebrand the combined entity as Columbia Bank later this year. The newly formed company will have approximately USD 70 billion in assets, establishing itself as a leader in the largest banking markets within the Western U.S.

Upon closing, Pacific Premier’s stockholders will hold around 30% of Columbia’s outstanding shares. The deal is expected to be finalized in the second half of 2025. Piper Sandler & Co. advised Columbia, while Keefe, Bruyette & Woods, a Stifel Company, acted as financial advisor to Pacific Premier.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of April 21 to 27, 2025. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter