- M&A News

M&A News: Global M&A Deals Week of April 28 to May 4, 2025

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

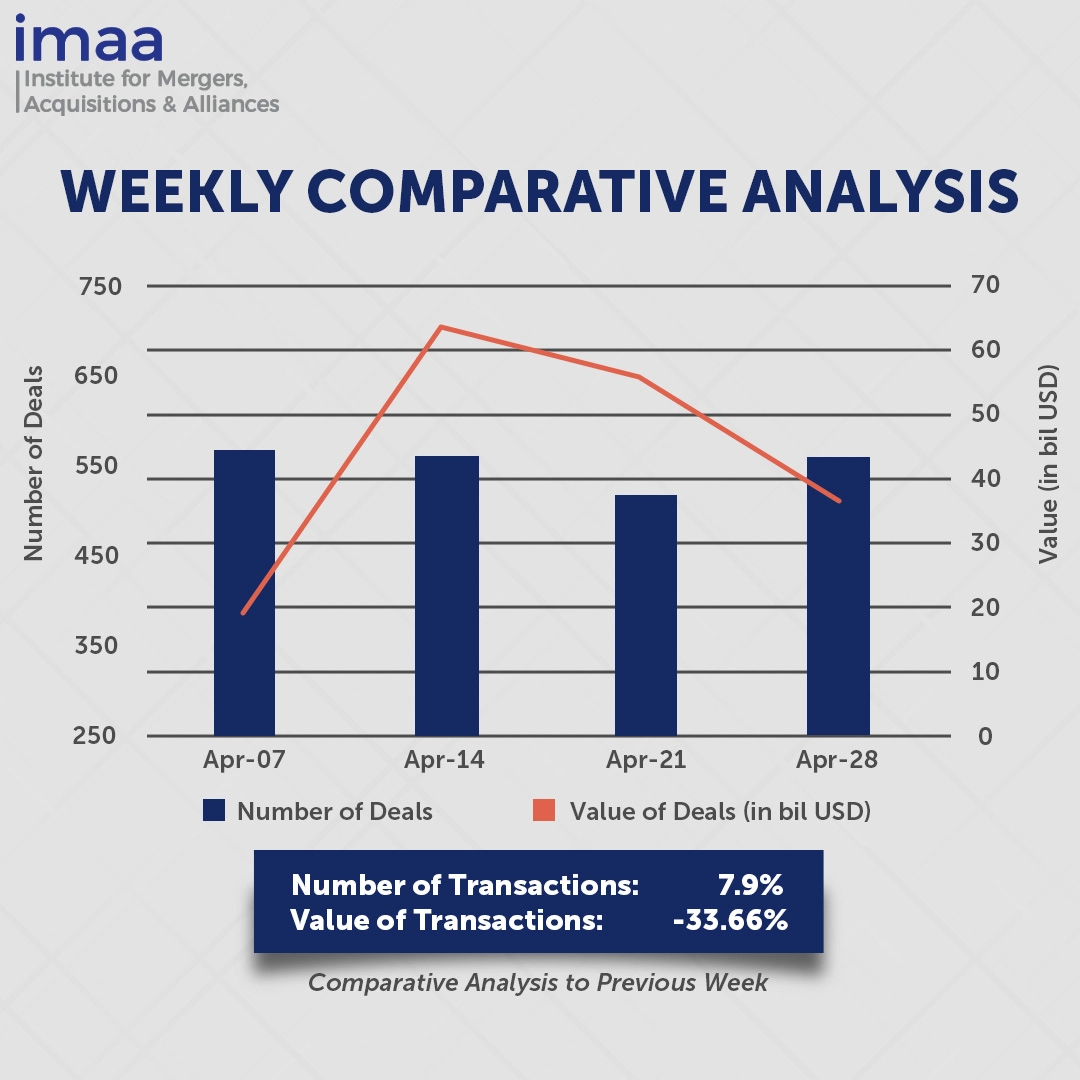

Between April 28 and May 4, the mergers and acquisitions (M&A) market recorded 563 transactions with a combined value of USD 36.84 billion. Fourteen of these transactions, each valued at over USD 500 million, contributed USD 28.93 billion, or 79% of the total deal value for the week.

The standout deal was Mediobanca’s USD 7.15 billion bid for Banca Generali, a major development in the ongoing consolidation of Italy’s banking sector. The proposed acquisition is a strategic effort by Mediobanca to counter an unsolicited takeover attempt by Banca Monte dei Paschi di Siena, whose earlier bid for Mediobanca was rejected. Mediobanca intends to fund the acquisition by divesting its stake in Assicurazioni Generali and redirecting the proceeds to Banca Generali. If successful, the deal would reposition Mediobanca with a core focus on wealth management, forming a significant player with approximately EUR 210 billion in client assets.

Compared to the previous week, deal volume rose by 8%, from 522 to 563 transactions. In contrast, deal value fell by 34%, from USD 55.53 billion to USD 36.84 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of April 28 to May 4, 2025 in detail:

Deal No. 1: Mediobanca Banca di Credito Finanziario S.p.A. to Acquire Banca Generali S.p.A. for USD 7.15 Billion

Deal No. 2: Merck KGaA to Acquire SpringWorks Therapeutics, Inc. for USD 3.90 Billion

Deal No. 3: Prio Tigris Ltda. to Acquire Peregrino Field in Brazil for USD 3.50 Billion

Deal No. 4: Novartis AG to Acquire Regulus Therapeutics Inc. for USD 1.70 Billion

Deal No. 5: TPG Capital, L.P. to Acquire Hospitality Solutions Business of Sabre Corporation for USD 1.10 Billion

Deal No. 1:

Mediobanca Banca di Credito Finanziario S.p.A. to Acquire Banca Generali S.p.A. for USD 7.15 Billion

Mediobanca has announced a EUR 6.3 billion (USD 7.15 billion) offer to acquire Banca Generali from Assicurazioni Generali, one of the world’s largest insurance groups. The proposed deal is part of a broader strategy to reinforce Mediobanca’s position in wealth management while fending off a takeover attempt by Monte dei Paschi.

Banca Generali, headquartered in Milan, specializes in providing wealth management and financial advisory services to affluent and high-net-worth individuals. The bank offers tailored investment strategies and a diverse range of banking products, supported by a wide network of financial advisors throughout Italy.

To finance the transaction, Mediobanca plans to offer its 13% stake in Assicurazioni Generali, where it currently holds the largest shareholding. This move signals a shift in their relationship—from a passive financial holding to a more integrated industrial alliance—and reflects Mediobanca’s intention to deepen its presence in the wealth management sector.

The merger is projected to deliver around EUR 300 million in synergies and significantly enhance Mediobanca’s profitability, with its return on tangible equity expected to rise from 14% to over 20%.

A shareholder meeting is set for June 16 to vote on the proposal, with completion of the exchange offer targeted by the end of October.

Public Voluntary Exchange Offer for 100% of Banca Generali shares – Mediobanca Group

Mediobanca hits back in Italy’s bank M&A war with $7 bln Banca Generali bid | Reuters

Mediobanca launches $7B Banca Generali bid to heat up Italy’s M&A war | Daily Sabah

Mediobanca Offers to Buy Banca Generali in $7 Billion Share Deal – WSJ

Deal No. 2:

Merck KGaA to Acquire SpringWorks Therapeutics, Inc. for USD 3.90 Billion

Germany-based Merck KGaA has agreed to acquire SpringWorks Therapeutics, a U.S.-based biopharmaceutical company focused on rare diseases and cancer, in a transaction valued at USD 3.9 billion.

SpringWorks is a clinical-stage firm specializing in precision medicine, with a pipeline centered on targeted therapies for rare and genetically defined tumors. The company is advancing treatments designed to meet critical gaps in oncology care, aiming to improve outcomes for patients with limited therapeutic options.

As part of the acquisition, Merck KGaA will gain access to Ogsiveo (nirogacestat), approved for the treatment of desmoid tumors, and Gomekli (mirdametinib), a MEK inhibitor approved in February 2025 for neurofibromatosis type 1 (NF1). Ogsiveo recorded USD 172 million in sales in 2024, underscoring its market potential.

The deal aligns with Merck KGaA’s long-term strategy to broaden its healthcare portfolio and deepen its focus on oncology, particularly in niche indications. It also supports the company’s goal of expanding its footprint in the U.S. pharmaceutical market.

Following completion, the acquisition is expected to immediately contribute to Merck KGaA’s revenue and become accretive to earnings per share (EPS) by 2027.

The transaction has received unanimous approval from both Merck KGaA and SpringWorks’ Boards of Directors and is expected to close in the second half of 2025. J.P. Morgan is serving as Merck’s exclusive financial advisor, while Centerview Partners LLC and Goldman Sachs & Co. LLC are acting as joint financial advisors to SpringWorks.

Deal No. 3:

Prio Tigris Ltda. to Acquire Peregrino Field in Brazil for USD 3.50 Billion

Equinor is selling its 60% interest in the Peregrino field, a significant offshore oil asset in Brazil, to PRIO Tigris, a subsidiary of PRIO, in a deal valued at USD 3.5 billion.

The transaction will be carried out in two phases. The first involves the acquisition of a 40% stake along with operatorship of the field, followed by the purchase of the remaining 20%.

Situated in the Campos Basin, about 85 kilometers off Rio de Janeiro’s coast, the Peregrino field commenced production in 2011 and extracts heavy crude oil with an API gravity between 13° and 16°. The field operates 27 production wells and six injector wells, supported by subsea infrastructure and the FPSO Peregrino, which is capable of processing 110,000 barrels of oil and handling up to 300,000 barrels of water daily.

A second development phase is underway, which involves the installation of a third wellhead platform designed to unlock an additional 250 million barrels of recoverable oil. This expansion is set to boost production and extend the field’s operational lifespan through 2040.

Equinor will continue to operate the field until the transaction is completed. Following the completion of both phases, PRIO will take full ownership and operational control, having previously acquired the remaining 40% from Sinochem in 2024. The deal is pending the usual regulatory and legal approvals in Brazil.

Deal No. 4:

Novartis AG to Acquire Regulus Therapeutics Inc. for USD 1.70 Billion

Swiss pharmaceutical leader Novartis is expanding its renal disease portfolio by acquiring Regulus Therapeutics for up to USD 1.7 billion, contingent on the achievement of regulatory milestones.

Regulus Therapeutics specializes in developing therapies that target microRNAs for genetically defined diseases. The company’s work primarily focuses on rare diseases, particularly kidney disorders, with its lead investigational drug, farabursen, aimed at treating autosomal dominant polycystic kidney disease (ADPKD). Farabursen is designed to reduce cyst growth and kidney enlargement, potentially slowing the progression of ADPKD. Regulus is known for its innovative approach to addressing complex diseases through oligonucleotide-based therapies.

Novartis’ extensive global development and commercial expertise will support the potential delivery of this new therapy to patients, pending regulatory approval.

The deal is set to close in the second half of the year. Upon completion, Novartis plans to merge the acquiring subsidiary with Regulus, making Regulus an indirect wholly owned subsidiary of the company. Evercore is serving as the exclusive financial advisor to Regulus.

Deal No. 5:

TPG Capital, L.P. to Acquire Hospitality Solutions Business of Sabre Corporation for USD 1.10 Billion

Global investment firm TPG has agreed to acquire Sabre’s Hospitality Solutions business in an all-cash transaction valued at USD 1.1 billion. The investment will be made through TPG Capital, the firm’s private equity platform for the U.S. and Europe.

Hospitality Solutions provides technology and software tailored for the hotel industry, supporting more than 40% of the world’s top hotel brands. Its offerings include tools for managing reservations, distribution, property operations, guest engagement, and revenue performance. Central to its services is the SynXis platform, which acts as a unified system for reservation and guest data, helping hotels improve operational efficiency.

TPG brings significant experience in executing corporate carveouts and scaling software businesses. The transaction will establish Hospitality Solutions as a standalone company with dedicated resources to accelerate growth and strengthen its position as a key technology provider in the hospitality sector.

Sabre plans to use proceeds from the sale primarily to reduce debt, improve its balance sheet, and refocus on its core travel technology operations and long-term growth strategy.

The deal is expected to close by the end of the third quarter of 2025. William Blair is serving as financial advisor to TPG, while Evercore is advising Sabre.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of April 28 to May 4, 2025. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter