- M&A News

M&A News: Global M&A Deals Week of April 7 to 13, 2025

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

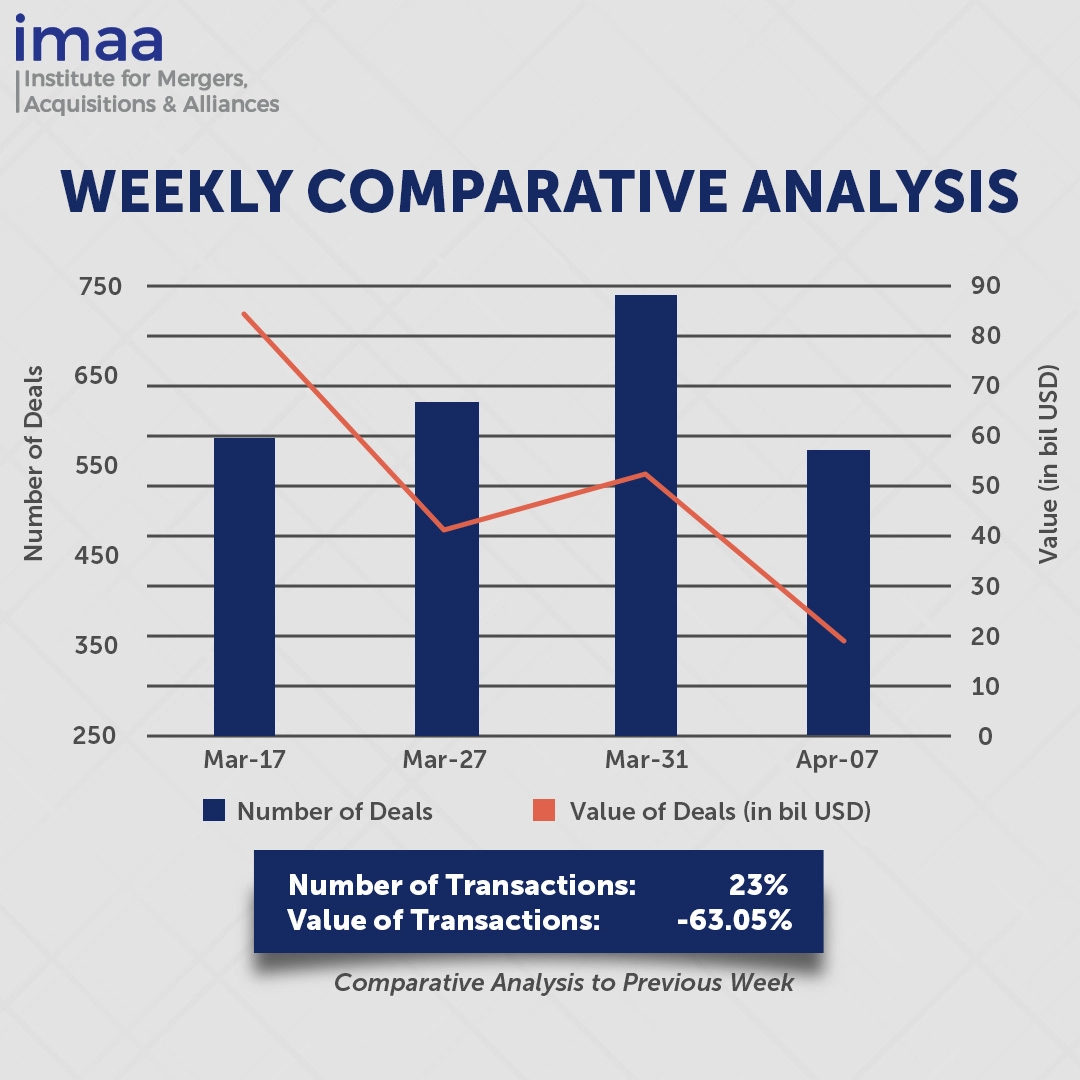

For the week of April 7 to April 13, mergers and acquisitions (M&A) activity experienced a notable decline, with 573 deals announced and a total disclosed value of USD 19.36 billion. Of these, 11 transactions exceeded the USD 500 million mark, contributing USD 14.14 billion—about 73% of the week’s total deal value.

Leading this week’s activity is Bain Capital’s USD 2.6 billion acquisition of HealthEdge Software, reflecting its strategic push in the healthcare technology space. HealthEdge provides a suite of integrated solutions that support critical operations for health insurers, such as claims processing, billing, and care management. As a core component of the health plan IT infrastructure, its systems are widely recognized for their ability to support complex healthcare environments. This acquisition aligns with Bain Capital’s broader strategy of investing in scalable, technology-driven healthcare solutions.

Despite the overall market slowdown—driven by lingering uncertainty around interest rates and global tensions—software assets continue to attract substantial private equity interest. Recent large-scale transactions include Clearlake Capital’s majority investment in Modernizing Medicine and Siemens AG’s USD 5.1 billion acquisition of the scientific software company Dotmatics.

Compared to the previous week, deal volume and value both saw sharp declines. The number of announced deals dropped by 23%, from 748 to 573, while total deal value fell 63%, from USD 52.41 billion to USD 19.36 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of April 7 to 13, 2025 in detail:

Deal No. 1: Bain Capital Private Equity, LP to Acquire HealthEdge Software, Inc. for USD 2.60 Billion

Deal No. 2: Infineon Technologies AG to Acquire Automotive Ethernet Business of Marvell Technology, Inc. for USD 2.50 Billion

Deal No. 3: Prada S.p.A. to Acquire Gianni Versace S.r.l. for USD 1.38 Billion

Deal No. 4: Ripple Labs Inc. to Acquire Hidden Road Inc. for USD 1.25 Billion

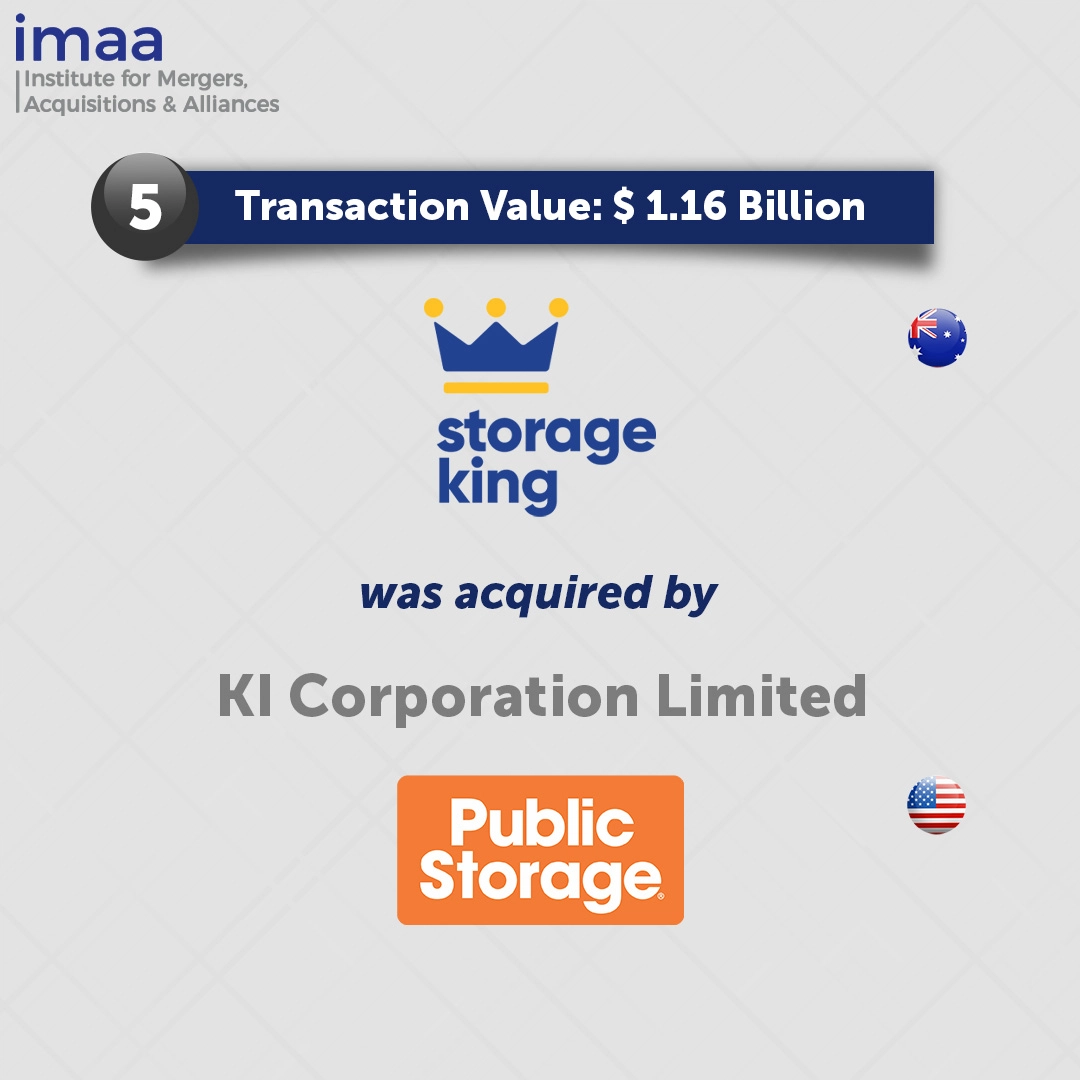

Deal No. 5: KI Corporation Limited; Public Storage, Inc. to Acquire Abacus Storage King for USD 1.16 Billion

Deal No. 1:

Bain Capital Private Equity, LP to Acquire HealthEdge Software, Inc. for USD 2.60 Billion

Bain Capital has agreed to acquire HealthEdge for approximately USD 2.6 billion from Blackstone, marking a significant move in its ongoing expansion into healthcare technology.

HealthEdge provides cloud-based platforms that integrate financial, administrative, and clinical functions for health insurers. Its software solutions support modernization efforts across the insurance value chain—from claims management to benefit plan design—serving more than 115 health plans and over 110 million covered lives across the United States. The company’s offerings are designed to lower administrative costs, enhance care quality, and enable insurers to adopt innovative business models in a rapidly changing healthcare landscape.

The acquisition complements Bain Capital’s broader strategy of investing in healthcare innovation. The firm, which manages USD 185 billion in assets, also owns Zelis, a healthcare payments company, and recently submitted a take-private offer for Surgery Partners.

The deal is expected to close in the second quarter of 2025. TripleTree is serving as the lead financial advisor to Bain Capital, while Evercore and UBS Investment Bank are advising Blackstone.

Deal No. 2:

Infineon Technologies AG to Acquire Automotive Ethernet Business of Marvell Technology, Inc. for USD 2.50 Billion

Infineon Technologies, Germany’s largest semiconductor manufacturer, is acquiring Marvell Technology’s Automotive Ethernet business for USD 2.5 billion in cash. This move will strengthen Infineon’s microcontroller portfolio and support its development of system solutions for software-defined vehicles.

Marvell’s Automotive Ethernet business, under the Brightlane brand, provides high-speed networking solutions essential for software-defined and autonomous vehicles. These include Ethernet switches, PHY transceivers, and camera bridges that support data rates ranging from 10 Mbps to 10 Gbps. These products are key to enabling zonal vehicle architectures, reducing wiring complexity, and supporting real-time data transfer for advanced driver-assistance systems (ADAS) and other safety features. Marvell’s solutions are used by over 50 automotive manufacturers, including eight of the top ten OEMs.

Ethernet technology is crucial for low-latency, high-bandwidth communication in software-defined vehicles and has potential applications in fields like humanoid robotics. Infineon plans to combine this technology with its AURIX microcontroller family, creating a comprehensive product suite that integrates communication and real-time control capabilities. This acquisition will further reinforce Infineon’s position as a leader in microcontrollers.

Following the transaction, Marvell’s automotive Ethernet business will become part of Infineon’s automotive division, with projected revenue of USD 225 million to USD 250 million in 2025 and a gross margin of nearly 60%. The deal is also expected to expand Infineon’s research and development footprint in the United States.

The acquisition is expected to close by the end of 2025.

Deal No. 3:

Prada S.p.A. to Acquire Gianni Versace S.r.l. for USD 1.38 Billion

Luxury fashion house Prada has reached an agreement with Capri Holdings to acquire Versace for USD 1.38 billion, uniting two iconic names in Italian fashion.

Versace, based in Milan, is a globally recognized symbol of Italian luxury, renowned for its bold aesthetic. The brand’s addition to the Prada Group portfolio enhances the group’s offerings, tapping into significant growth potential and complementing its existing brands with new opportunities for value creation.

This acquisition marks the return of Versace to Italian ownership, positioning the brand to compete more effectively with larger luxury conglomerates such as LVMH and Kering SA. It also strengthens Italy’s presence in the luxury sector, which is dominated by French corporations like LVMH.

For Prada, known for its more understated aesthetic, the acquisition introduces a new level of diversity within its portfolio. Prada’s leadership emphasizes that this move adds a complementary dimension to the group, ensuring Versace retains its creative independence and cultural essence while benefiting from Prada’s operational and retail expertise.

The deal is expected to be finalized by the second half of 2025. Citigroup Global Markets Europe AG and Goldman Sachs Bank Europe SE, Succursale Italia, are serving as financial advisors to Prada Group.

Deal No. 4:

Ripple Labs Inc. to Acquire Hidden Road Inc. for USD 1.25 Billion

Blockchain technology firm Ripple is set to acquire Hidden Road, a leading multi-asset prime brokerage firm, for USD 1.25 billion, marking one of the largest transactions in the digital asset sector to date.

Hidden Road specializes in clearing, prime brokerage, and financing services across various asset classes, including foreign exchange, digital assets, derivatives, swaps, and fixed income. The firm clears over USD 3 trillion annually and serves more than 300 institutional clients, such as hedge funds. Additionally, Hidden Road operates a global credit network that connects institutions to both traditional and digital markets.

This acquisition positions Ripple as the first cryptocurrency company to own and operate a global, multi-asset prime broker. It also aims to position Hidden Road as the largest non-bank prime broker globally, expanding Ripple’s presence in the US market. By combining Ripple’s and Hidden Road’s capabilities, the acquisition promises to scale institutional access to digital assets, bridging traditional finance with decentralized finance.

Hidden Road will integrate Ripple’s USD (RLUSD) stablecoin as collateral across its prime brokerage services, enabling cross-margining between digital and traditional markets. The firm will also move its post-trade operations to the XRP Ledger, a decentralized blockchain designed for efficient and cost-effective transactions.

The transaction is anticipated to close in the coming months, pending regulatory approval.

Ripple Acquires Prime Broker Hidden Road | Ripple

Ripple acquires Hidden Road in $1.25B deal to expand institutional crypto services – SiliconANGLE

Crypto firm Ripple to buy prime broker Hidden Road for $1.25 billion | Reuters

Ripple Buys Broker Hidden Road for $1.25 Billion, CTO Schwartz Calls it ‘Defining Moment’ for XRPL

Deal No. 5:

KI Corporation Limited; Public Storage, Inc. to Acquire Abacus Storage King for USD 1.16 Billion

Abacus Storage King, a self-storage REIT with a presence across Australia and New Zealand, has received a takeover offer valued at AUD 1.93 billion (USD 1.16 billion) from Ki Corporation and U.S.-based REIT Public Storage.

As one of the region’s largest self-storage operators, Abacus Storage King oversees approximately 126 operational facilities, 21 development sites, and 75 managed or licensed properties. The self-storage market in Australia and New Zealand continues to grow, fueled by strong population inflows, resilient economic conditions, and increasing consumer adoption. Despite this growth, ownership in the sector remains fragmented, presenting opportunities for consolidation.

Ki Corporation, currently the largest securityholder in Abacus Storage King, along with Public Storage, would each hold a 50% stake in the company following the transaction. The consortium’s offer includes an attractive premium, providing minority investors with both value and deal certainty.

With its extensive industry expertise, Public Storage aims to enhance Abacus Storage King’s operational performance and customer service while supporting future growth and portfolio development. The acquisition is expected to position the company for continued success in the expanding self-storage market.

Abacus Storage King has formed an independent board committee to review the proposal. Macquarie is serving as Abacus Storage King’s financial advisor, while Goldman Sachs is advising the consortium.

Public Storage – Ki Corporation and Public Storage Offer a Premium to Acquire Abacus Storage King

ASK ASX: Billionaire Nathan Kirsh offers $1.9b buy-out for Abacus Storage King

Public Storage offers premium in $1.9b play for Storage King

Australia’s Abacus Storage King gets takeover bid, valuing firm at $1.2 billion | Reuters

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of April 7 to 13, 2025. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter