- M&A News

M&A News: Global M&A Deals Week of June 2 to 8, 2025

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

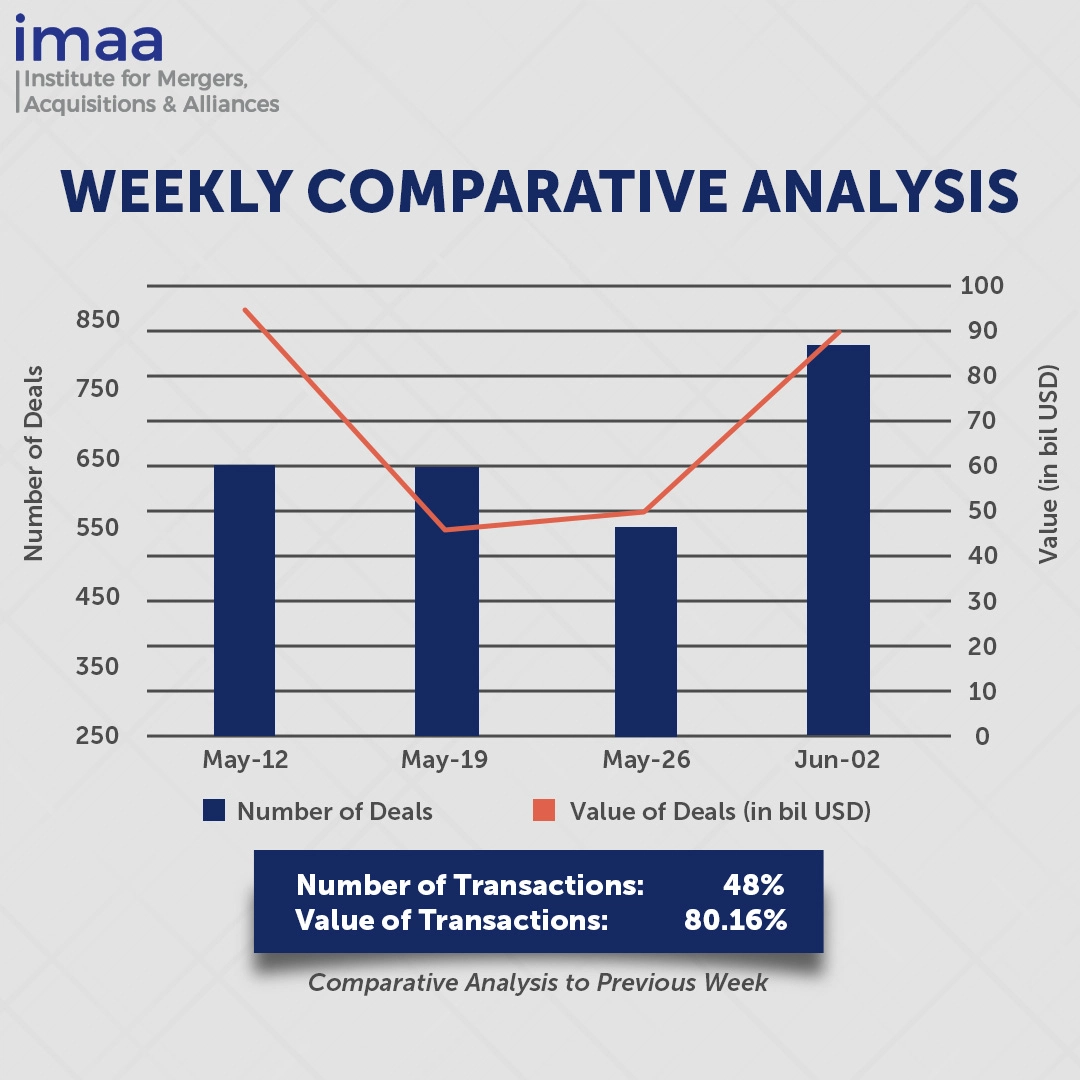

The mergers and acquisitions (M&A) landscape saw strong momentum in the first week of June, with a significant uptick in both deal volume and value. Between June 2 and June 8, a total of 815 transactions were announced, amounting to a combined value of USD 88.76 billion. Notably, 20 of these deals were each valued at over USD 500 million, contributing USD 78.65 billion—or 89%—of the total deal value for the week.

The standout transaction during this period is the Toyota Group’s acquisition of Toyota Industries in a USD 33 billion take-private transaction. This marks one of the largest corporate restructurings in Japan’s recent history and reflects a strategic realignment of Toyota’s group structure. The transaction will be executed through a tender offer by Toyota Fudosan and Toyota Motor.

Toyota Industries plays a critical role within the Toyota ecosystem. In addition to manufacturing forklifts, it produces the RAV4 SUV and supplies key components such as engines, batteries, air-conditioning compressors, and power converters. This acquisition reflects Toyota’s strategic push to simplify its group structure while reinforcing control over essential operations and supply chains amid the industry’s rapid evolution toward electrification and automation.

Week-over-week data shows a 48% increase in deal count—from 550 to 815 transactions—while total deal value jumped by 80%, rising from USD 49.27 billion to USD 88.76 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of June 2 to 8, 2025 in detail:

Deal No. 1: Toyota Fudosan Co., Ltd.; Toyota Motor Corporation to Acquire Toyota Industries Corporation for USD 33.00 Billion

Deal No. 2: Sanofi to Acquire Blueprint Medicines Corporation for USD 9.50 Billion

Deal No. 3: Viper Energy, Inc. to Acquire Sitio Royalties Corp. for USD 4.10 Billion

Deal No. 4: Washington H. Soul Pattinson and Company Limited to Acquire Brickworks Limited for USD 3.00 Billion

Deal No. 5: Photon AI Ltd to Acquire Multiven, Inc. for USD 2.20 Billion

Deal No. 1:

Toyota Fudosan Co., Ltd.; Toyota Motor Corporation to Acquire Toyota Industries Corporation for USD 33.00 Billion

Toyota Industries Corporation is going private through a USD 33 billion buyout backed by Toyota Motor and Toyota Fudosan, signaling a deepened alignment within the Toyota Group.

Toyota Industries plays a pivotal role within the group and specializes in a broad range of sectors, including materials handling equipment such as forklifts, automotive components, textile machinery, and logistics solutions.

A new holding company will be formed for the transaction. Toyota Fudosan will contribute JPY 180 billion, while Akio Toyoda, chairman of Toyota Motor, will invest JPY 1 billion. Toyota Motor itself plans to invest JPY 700 billion in non-voting preferred shares. As part of the restructuring, Toyota Motor and its affiliated suppliers—Aisin, Denso, and Toyota Tsusho—will divest their stakes in Toyota Industries and repurchase shares currently held by Toyota Industries in their own firms.

The deal highlights Toyota’s strategic push to simplify its corporate structure while retaining influence over essential supply chain operations amid the industry’s shift toward electrification and automation. In this context, Toyota Industries is enhancing its focus on smart logistics, advancing autonomous forklift technologies, logistics management software, eco-efficient powertrains, and leveraging data related to goods movement to support increasingly complex logistics demands.

Deal No. 2:

Sanofi to Acquire Blueprint Medicines Corporation for USD 9.50 Billion

French pharmaceutical giant Sanofi is acquiring the US biopharmaceutical firm Blueprint Medicines for up to USD 9.5 billion, strengthening its position in rare immunological diseases and enhancing its early-stage immunology pipeline.

Blueprint Medicines focuses on developing precision therapies that target genetic drivers of cancer and rare disorders. Its flagship drug, Ayvakit (avapritinib), is approved in the US and EU for treating advanced systemic mastocytosis and gastrointestinal stromal tumors with specific KIT or PDGFRA mutations. The company’s expertise lies in selective kinase inhibitors and the use of genomic profiling to create personalized treatments for patients with genetically defined oncological and immunological conditions.

The acquisition includes Ayvakit, as well as Blueprint’s promising immunology portfolio, featuring elenestinib in mid-to-late stage clinical trials for systemic mastocytosis, alongside an earlier-stage investigational candidate with potential applications across a broad spectrum of immunological diseases. Blueprint’s strong relationships with allergists, dermatologists, and immunologists are also expected to complement and enhance Sanofi’s expanding immunology portfolio.

Sanofi anticipates the transaction will be immediately accretive to its gross margin and will contribute positively to its operating profit and earnings per share from 2027 onward.

The deal is expected to be finalized in the third quarter of this year.

Deal No. 3:

Viper Energy, Inc. to Acquire Sitio Royalties Corp. for USD 4.10 Billion

Viper Energy has agreed to acquire Sitio Royalties through an all-equity transaction valued at approximately USD 4.1 billion. This deal will establish one of North America’s largest publicly traded mineral and royalty companies, significantly increasing Viper’s asset portfolio, operational scale, and financial flexibility.

Sitio Royalties is a pure-play mineral and royalty company focused on acquiring high-quality oil and gas interests across major U.S. basins. It employs a broad consolidation strategy, collaborating with numerous exploration and production operators to deliver sustained value for its shareholders.

The company currently holds approximately 34,300 net royalty acres, including 25,300 acres in the Permian Basin and another 9,000 spread across other prolific basins such as the DJ, Eagle Ford, and Williston. Notably, nearly half of Sitio’s Permian acreage overlaps with existing Viper-operated wells. In the first quarter of 2025, Sitio reported average production of 18.9 thousand barrels per day (mbo/d), with 14.5 mbo/d attributed to the Permian.

Post-merger, the combined company will control around 85,700 net royalty acres within the Permian Basin, with roughly 41% of those acres operated by Diamondback Energy. The projected production for Q4 2025 is estimated between 64 and 68 mbo/d (or 122 to 130 mboe/d).

This acquisition strengthens Viper’s standing among mid- and large-cap exploration and production companies in North America by offering high margins, low operating expenses, and one of the industry’s lowest dividend breakeven thresholds.

The transaction is expected to finalize by the third quarter of 2025. Moelis & Company LLC is advising Viper Energy, while J.P. Morgan Securities LLC serves as exclusive financial advisor to Sitio Royalties.

Deal No. 4:

Washington H. Soul Pattinson and Company Limited to Acquire Brickworks Limited for USD 3.00 Billion

Australian investment firm Washington H. Soul Pattinson (Soul Patts) intends to acquire the remaining 57% of Brickworks for approximately USD 3 billion, in a deal that would create a combined entity valued at AUD 14 billion (USD 9.03 billion).

Brickworks is the largest brick manufacturer in Australia, supplying a wide range of construction materials across both Australia and North America. Beyond its core manufacturing operations, the company also owns significant industrial property assets and holds a diversified portfolio of investments. Soul Patts currently owns 43% of Brickworks, while Brickworks holds a 26% stake in Soul Patts, forming a cross-shareholding arrangement that has existed for nearly sixty years.

The proposed merger, to be implemented through dual Schemes of Arrangement, is designed to dismantle this longstanding ownership structure. It aims to enhance corporate governance by consolidating decision-making under a single executive team, removing cross-shareholdings, and streamlining strategic capital deployment.

The combined entity will be named Washington H. Soul Pattinson and Company Limited. Post-transaction, Soul Patts shareholders will own 72% of the new entity, while Brickworks shareholders will hold 19%, and new TopCo shareholders will own the remaining 9%.

The merger offers strategic benefits to both shareholder groups. Soul Patts investors will gain increased exposure to Brickworks’ building products business in Australia and the United States, including its 50% stake in joint ventures with Goodman Group. Brickworks shareholders, in turn, will benefit from broader access to Soul Patts’ diverse portfolio, spanning private equity, credit, listed equities, and property investments.

Pitt Capital Partners is acting as financial advisor to Soul Pattinson, while Citigroup Global Markets Australia is advising Brickworks.

Deal No. 5:

Photon AI Ltd to Acquire Multiven, Inc. for USD 2.20 Billion

PhotonAI, Africa’s pioneering AI infrastructure and foundational model company, has announced its acquisition of global cyberdefense leader Multiven in an all-digital asset transaction valued at USD 2.2 billion, denominated in Boomcoin (BMC).

Multiven is a global cybersecurity company specializing in decentralized software integrity maintenance and cyber-defense services for internet infrastructure equipment and blockchain nodes. It supports a broad client base, including governments and Fortune 500 corporations such as AT&T, Barclays Bank, AB InBev, IKEA, Capgemini, Thales, Dassault Systèmes, and Orange, helping secure global internet networks through its vendor-neutral platform.

The move positions PhotonAI as the first AI company to integrate military-grade cyberdefense across its entire AI technology stack, from large language model (LLM) inference systems to decentralized data centers. With Africa’s AI market projected to generate over USD 3 trillion in economic value by 2030, PhotonAI is uniquely positioned to meet the surging demand for sovereign AI compute, cyber protection, and localized large language models. Despite strong fundamentals, mobile-first adoption, youthful demographics, and rising policy momentum, Africa still lacks critical AI infrastructure—something PhotonAI aims to provide.

The acquisition is financed through a USD 2.5 billion structured loan facility issued entirely in Boomcoin by Boom Group Holdings.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of June 2 to 8, 2025. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter