- M&A News

M&A News: Global M&A Deals Week of March 24 to 30, 2025

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

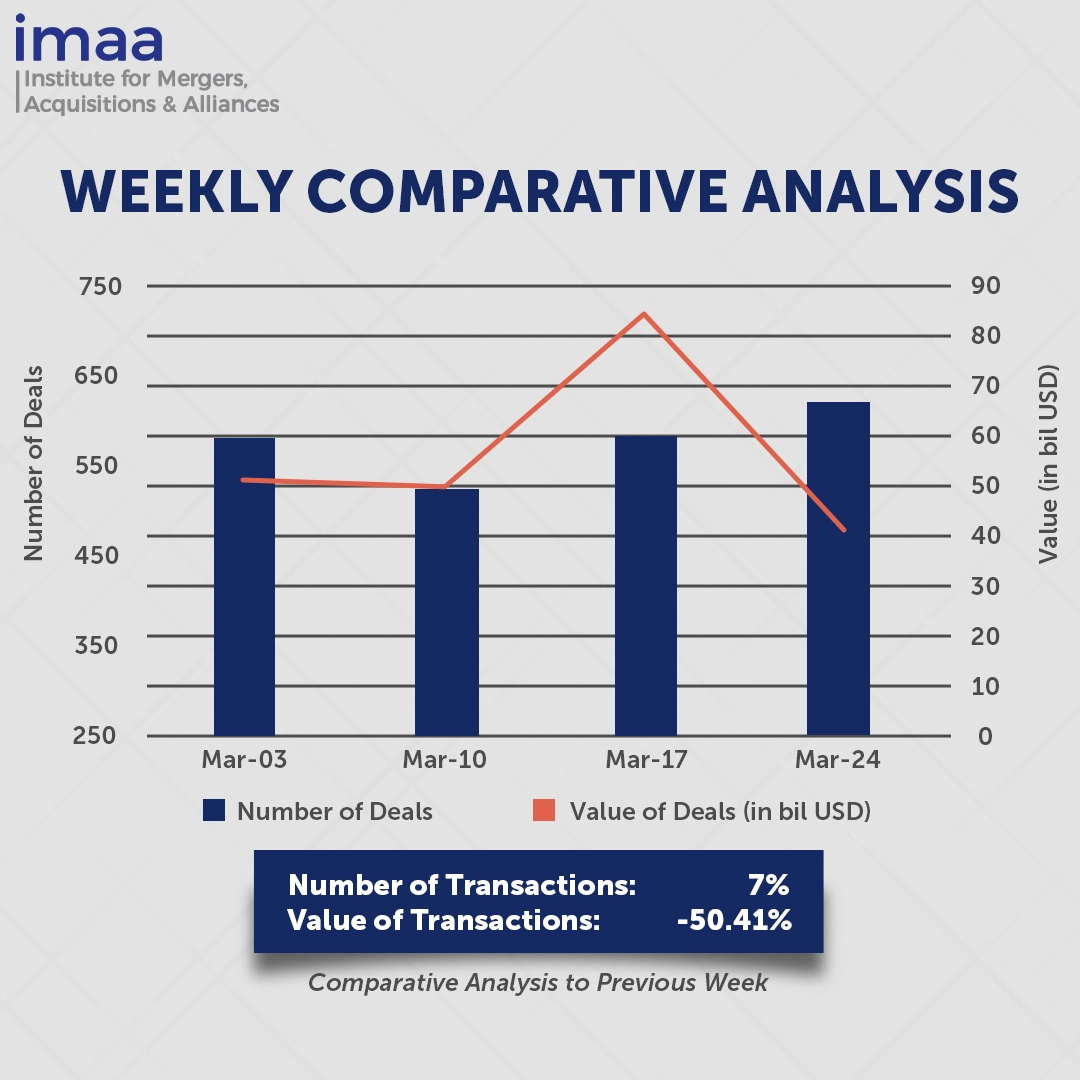

Between March 24 and March 30, the global mergers and acquisitions (M&A) market recorded 630 deals, totaling USD 41.63 billion. Notably, 14 of these transactions exceeded USD 500 million each, accounting for USD 32.15 billion—representing 77% of the overall deal value.

The week’s largest transaction was ENN Natural Gas’ USD 11.6 billion takeover bid for ENN Energy, intended to streamline its natural gas operations and take the company private. This move reflects a wider trend in China’s energy sector, where major players are consolidating assets to boost operational efficiency. By privatizing ENN Energy, ENN Natural Gas seeks to free itself from the constraints of public shareholders, allowing it to concentrate on long-term strategic investments and decisions without the pressure of quarterly earnings reports. Additionally, the deal aims to optimize capital allocation as China continues to reshape its natural gas sector in response to growing domestic demand and a drive to reduce dependence on foreign energy sources. With this consolidation, ENN Natural Gas aims to accelerate its expansion, enhance supply chain efficiency, and strengthen energy security.

Compared to the previous week, deal volume increased by 7%, rising from 590 to 630 deals. However, the total deal value experienced a sharp decline of 50.4%, dropping from USD 83.95 billion to USD 41.63 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of March 24 to 30, 2025 in detail:

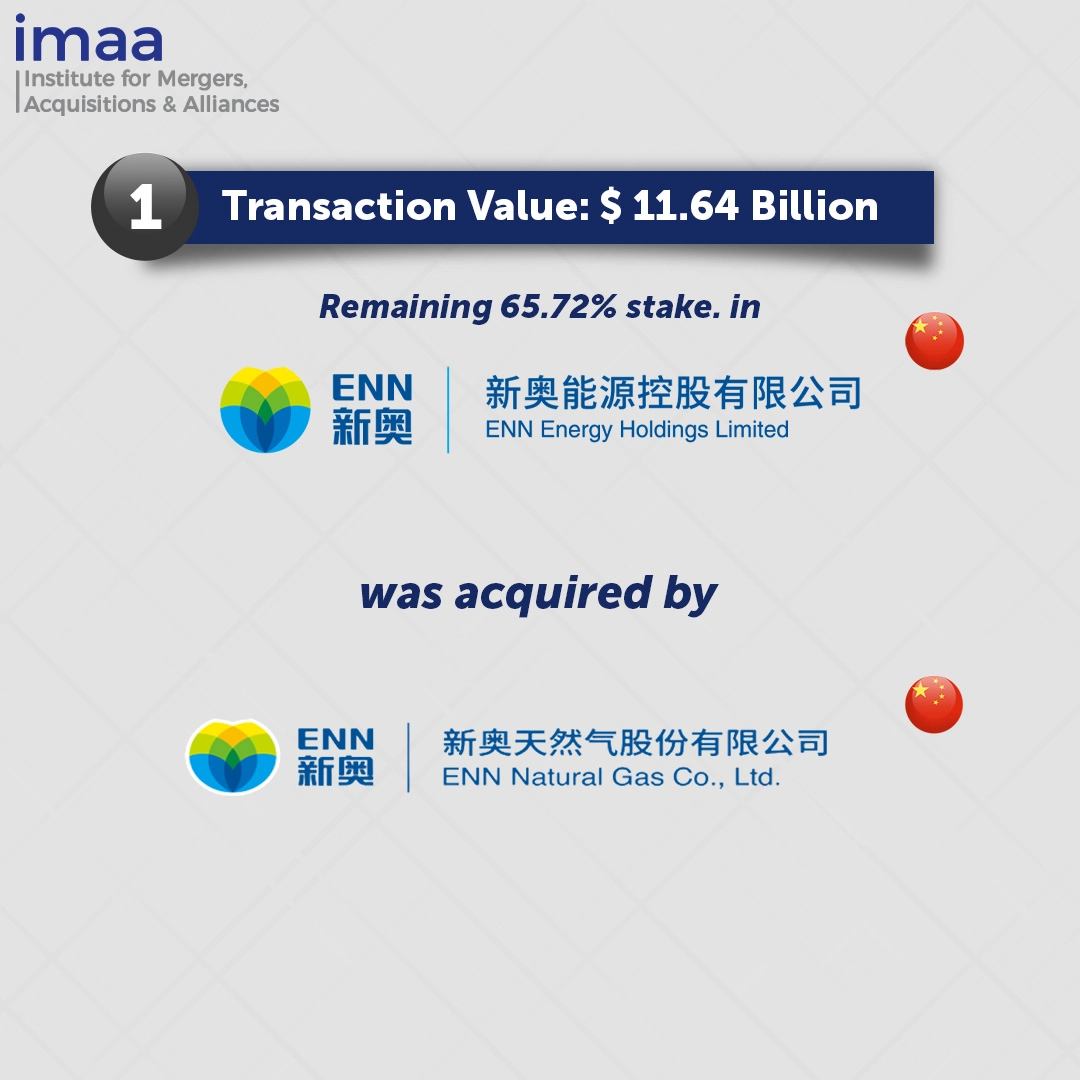

Deal No. 1: ENN Natural Gas Co., Ltd. to Acquire ENN Energy Holdings Limited for USD 11.64 Billion

Deal No. 2: Clearlake Capital Group, L.P. to Acquire Dun & Bradstreet Holdings, Inc. for USD 7.70 Billion

Deal No. 3: KKR & Co. Inc.; JIC Capital Co., Ltd. to Acquire Topcon Corporation for USD 2.31 Billion

Deal No. 4: Roper Technologies, Inc. to Acquire CentralReach, LLC for USD 1.65 Billion

Deal No. 5: Prysmian S.p.A. to Acquire Channell Commercial Corporation for USD 1.15 Billion

Deal No. 1:

ENN Natural Gas Co., Ltd. to Acquire ENN Energy Holdings Limited for USD 11.64 Billion

ENN Natural Gas has made a USD 11.6 billion (HKD 90.50 billion) takeover offer for ENN Energy, aiming to consolidate its natural gas operations and improve efficiency. The company currently holds a 34.28% stake in ENN Energy and seeks to acquire the remaining shares for full ownership.

ENN Energy focuses on the construction, operation, and management of gas pipeline infrastructure while supplying piped gas, LNG, and other multi-energy products. Meanwhile, ENN Natural Gas operates China’s first large-scale private LNG terminal and oversees more than 250 city gas projects nationwide, with an annual LNG distribution capacity exceeding 10 billion cubic meters (bcm).

The proposed acquisition aligns with Beijing’s broader push for energy security, encouraging domestic companies to increase production and expand natural gas output to reduce reliance on foreign imports. Full ownership of ENN Energy would allow ENN Natural Gas to implement a more unified strategy, optimizing costs and enhancing its ability to respond to market demands.

Privatization would also support China’s ongoing efforts to modernize its energy infrastructure, improving the efficiency of natural gas distribution and consumption.

Deal No. 2:

Clearlake Capital Group, L.P. to Acquire Dun & Bradstreet Holdings, Inc. for USD 7.70 Billion

Clearlake Capital, a Los Angeles-based private equity firm, has agreed to acquire Dun & Bradstreet, a provider of business data and analytics, in a transaction valued at USD 7.7 billion, including debt.

Dun & Bradstreet specializes in business intelligence, offering data-driven insights and risk management solutions to organizations worldwide. The company maintains an extensive database that supports businesses in evaluating credit risk, conducting due diligence, and making strategic decisions. With a globally recognized brand and a robust suite of analytics, Dun & Bradstreet plays a key role in enabling data-driven decision-making across industries.

As businesses become more dependent on data to navigate intricate markets, Dun & Bradstreet is positioned to broaden its AI-driven offerings to meet the evolving needs of its global client base. Clearlake Capital plans to foster the company’s growth by utilizing its expertise and resources to improve operational efficiency and drive innovation.

The acquisition is expected to close in the third quarter of 2025, after which Dun & Bradstreet will transition into a privately held entity, delisting from public markets. Clearlake’s financial advisors on the transaction include Morgan Stanley, Goldman Sachs, JPMorgan, Rothschild & Co, Barclays, Citi, Deutsche Bank, Santander, and Wells Fargo. BofA Securities is advising Dun & Bradstreet.

Deal No. 3:

KKR & Co. Inc.; JIC Capital Co., Ltd. to Acquire Topcon Corporation for USD 2.31 Billion

KKR and the state-backed Japan Investment Corp. (JIC) are acquiring Topcon Corporation for USD 2.31 billion (JPY 348 billion).

KKR plans to invest roughly JPY 256 billion to secure a controlling stake, while JIC will invest around JPY 95 billion for a minority interest.

Topcon is recognized globally for its innovative solutions addressing key challenges in sectors such as healthcare, agriculture, and infrastructure. The company excels in developing optical, sensing, and control technologies, utilizing cutting-edge digital transformation tools to serve these industries effectively.

In addition, Topcon utilizes its advanced optical technology to create products for the space and defense sectors, which play a critical role in Japan’s national security. JIC’s investment is expected to bolster the company’s growth in these vital areas, strengthening its long-term value.

For KKR, Japan is a crucial market within its broader Asia-Pacific and global strategy, with around USD 18 billion in assets under management in the country. KKR aims to support Topcon’s privatization growth by leveraging its global network, deep operational expertise, and extensive experience in ophthalmology, healthcare, and industrial investments. This partnership will help Topcon expand internationally, with particular emphasis on growing its presence in the U.S. market, a key strategic focus.

The tender offer is expected to begin in late July 2025.

Deal No. 4:

Roper Technologies, Inc. to Acquire CentralReach, LLC for USD 1.65 Billion

Roper Technologies has revealed its decision to acquire CentralReach, a leading provider of Software-as-a-Service (SaaS) solutions for autism and intellectual and developmental disabilities (IDD) care, with a focus on applied behavior analysis (ABA), for a total consideration of USD 1.65 billion.

CentralReach offers specialized software designed to assist healthcare providers in ABA therapy, special education, and related therapeutic services. Its comprehensive platform includes tools for practice management, clinical data collection, and billing, all tailored to enhance operational efficiency and patient care, particularly for individuals with autism and developmental disabilities.

CentralReach has solidified its position as a market leader, delivering essential solutions that offer high return on investment (ROI). The company benefits from a strong recurring revenue model, exceptional customer retention, and consistent organic growth, contributing to strong cash flow generation.

This acquisition is expected to positively impact Roper’s financial performance, with CentralReach projected to contribute approximately USD 175 million in revenue and USD 75 million in EBITDA by June 2026. Roper expects CentralReach to maintain sustainable organic growth in revenue and EBITDA at a rate exceeding 20%.

Upon completion of the deal, CentralReach will continue to operate independently, maintaining its leadership, team, brand, product offerings, and mission. The transaction is expected to close between April and May 2025.

Deal No. 5:

Prysmian S.p.A. to Acquire Channell Commercial Corporation for USD 1.15 Billion

Prysmian, Italy’s leading manufacturer of fiber optic cables, has reached an agreement to acquire Channell Commercial Corp, a prominent provider of integrated connectivity solutions in the United States, for up to USD 1.15 billion. This acquisition strengthens Prysmian’s presence in the U.S. market.

Channell is a well-established player in the U.S. connectivity sector, operating three manufacturing facilities in Texas, Nevada, and California. The company specializes in the design and production of telecommunications equipment, including thermoplastic and metal enclosures, copper termination and connection products, fiber optic cable management systems, heat shrink and water protection products, and grade-level boxes. Its diverse customer base spans major players in the Telecommunications, Broadband, Utility, and Power sectors.

This acquisition represents Prysmian’s inaugural major move into the digital solutions space and will accelerate its transformation from a cable manufacturer to a solutions provider.

The combined strengths of Prysmian and Channell—along with Channell’s expanded commercial reach and complementary R&D capabilities—will bolster Prysmian’s North American presence, supporting growth in data centers and advancing the deployment of FTTX and 5G technologies in both the U.S. and Europe. Channell will become part of Prysmian’s Digital Solutions division.

The deal is expected to close in the second quarter of 2025. Goldman Sachs & Co. LLC served as the exclusive financial advisor to Channell, while Freshfields acted as legal advisor to Prysmian.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of March 24 to 30, 2025. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter