- M&A News

M&A News: Global M&A Deals Week of March 31 to April 6, 2025

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

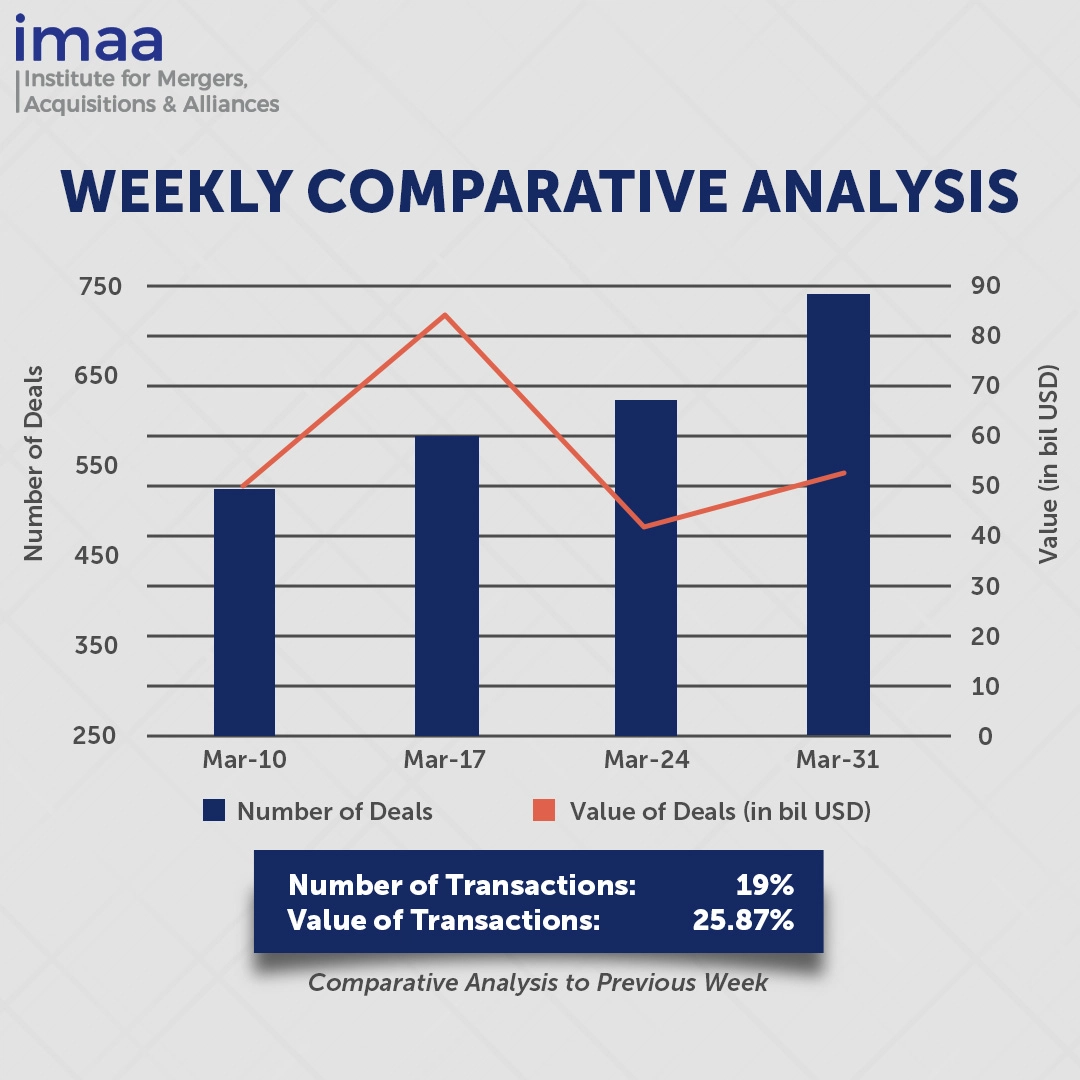

From March 31 to April 6, the global mergers and acquisitions (M&A) market recorded 748 announced deals, totaling USD 52.41 billion in value. Thirteen of these transactions surpassed the USD 500 million threshold, collectively valued at USD 42.88 billion, accounting for 82% of the total deal value for the week.

A standout deal of the week was Rocket Companies’ USD 9.4 billion all-stock acquisition of Mr. Cooper Group, its second significant deal this month as it aims to expand its mortgage-related services on its online platform. Earlier in the month, Rocket, primarily known for its mortgage lending business, acquired the real estate listing platform Redfin. Despite a challenging U.S. housing market marked by high mortgage rates and inflated home prices, recent improvements in housing inventory and a drop in long-term bond yields have revitalized interest from potential buyers. In its ongoing acquisition spree, Rocket seeks to offer a comprehensive, one-stop solution for prospective homebuyers.

Another major deal is Brookfield Infrastructure Partners’ USD 9 billion acquisition of Colonial Pipeline. Colonial operates the largest refined products pipeline network in the U.S., spanning approximately 5,500 miles from Texas to New York. Due to stringent government regulations and tariffs, building new pipelines in the U.S. remains a significant challenge, despite previous energy policies. This acquisition underscores Brookfield’s strategic expansion into the vital infrastructure sector.

Weekly comparisons show a 19% increase in deal volume, rising from 630 to 748 deals, and a jump in total deal value from USD 41.63 billion to USD 52.41 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of March 31 to April 6, 2025 in detail:

Deal No. 1: Rocket Companies, Inc. to Acquire Mr. Cooper Group Inc. for USD 9.40 Billion

Deal No. 2: Brookfield Infrastructure Partners L.P. to Acquire Colonial Enterprises, Inc. for USD 9.0 Billion

Deal No. 3: EQT AB (publ); First Kraft Ab to Acquire Fortnox AB for USD 5.50 Billion

Deal No. 4: Siemens AG to Acquire GraphPad Software, LLC dba Dotmatics for USD 5.10 Billion

Deal No. 5: LPL Holdings, Inc. to Acquire Commonwealth Financial Network for USD 2.70 Billion

Deal No. 1:

Rocket Companies, Inc. to Acquire Mr. Cooper Group Inc. for USD 9.40 Billion

Rocket Companies, a prominent U.S. mortgage lender, is set to acquire Mr. Cooper Group in an all-stock transaction valued at approximately USD 9.4 billion, inclusive of debt. This acquisition will create a formidable force in the mortgage industry, serving nearly 10 million clients—equivalent to one in every six mortgages nationwide.

This move follows Rocket’s recent acquisition of real estate platform Redfin, aligning with its strategy to expedite the development of its AI-powered platform designed to simplify the homebuying process. The integration of Redfin and Mr. Cooper is expected to streamline the housing journey and improve the overall customer experience.

Mr. Cooper, one of the largest mortgage servicers in the U.S., provides a wide range of services including home loan origination, refinancing, and servicing, leveraging digital tools and personalized customer support. Its well-established servicing infrastructure will complement Rocket’s expertise in mortgage origination and customer acquisition.

By combining Rocket’s end-to-end mortgage model with Mr. Cooper’s extensive servicing capabilities, the merger is expected to reduce operational costs and improve customer satisfaction. Additionally, the transaction is projected to generate approximately USD 500 million in annual revenue and cost synergies, driving long-term growth and enhancing operational efficiency.

The deal is expected to close in the fourth quarter of 2025. Upon completion, Rocket shareholders will own about 75% of the combined company, while Mr. Cooper shareholders will hold the remaining 25%. J.P. Morgan is advising Rocket Companies, while Citigroup Global Markets is serving as financial advisor to Mr. Cooper.

Deal No. 2:

Brookfield Infrastructure Partners L.P. to Acquire Colonial Enterprises, Inc. for USD 9.0 Billion

Brookfield Infrastructure Partners has agreed to acquire Colonial Enterprises, the owner of Colonial Pipeline, the largest fuel transportation system in the U.S., for USD 9 billion.

Colonial Pipeline stretches approximately 5,500 miles, linking the Gulf Coast to the East Coast. It plays a vital role in transporting essential refined petroleum products such as gasoline, diesel, and jet fuel. As the nation’s largest refined products pipeline system, it is a pivotal component of the U.S. energy infrastructure, consistently demonstrating high utilization and performance while serving a distinguished customer base along the East Coast.

The deal involves the full acquisition of shares from Colonial’s five stakeholders: Koch Industries (28.1%), KKR (23.4%), CDPQ (16.5%), Shell PLC (16.13%), and IFM Investors Pty (15.8%). This acquisition comes amid ongoing challenges, including delays in federal permitting processes and increasing political opposition, which have made it more difficult to build new pipelines across the U.S.

The transaction is expected to finalize in the second half of 2025. Debt financing for the deal is being led by Morgan Stanley and Mizuho Bank Ltd. Brookfield Infrastructure has engaged Jefferies LLC, Greenhill & Co. LLC, and Morgan Stanley & Co. LLC as joint financial advisors for this transaction.

Deal No. 3:

EQT AB (publ); First Kraft Ab to Acquire Fortnox AB for USD 5.50 Billion

Fortnox, a Swedish provider of cloud-based business solutions, has received a buyout proposal valued at SEK 54.9 billion (USD 5.5 billion) from a consortium led by EQT AB, with plans to take the company private.

Fortnox offers a suite of digital tools for accounting, invoicing, payroll, and financial services, catering mainly to small and medium-sized enterprises (SMEs), accounting firms, and organizations.

The bidding group consists of EQT and First Kraft AB, which is wholly owned by Olof Hallrup, Fortnox’s chairman and largest shareholder. First Kraft, which currently holds an 18.9% stake in Fortnox, will contribute its shares to the newly formed consortium with EQT.

As Fortnox enters a pivotal stage in its growth, further expansion is expected to demand substantial investment in product innovation and potential acquisitions—initiatives that come with increased operational and financial risks. The consortium believes such efforts would be more effectively pursued in a private setting.

EQT brings extensive experience in scaling software and fintech companies, supported by a strong network of industry advisors and proven value-creation capabilities. Hallrup, with deep institutional knowledge and a long-standing commitment to the company, complements EQT’s strengths. Together, the consortium aims to support Fortnox’s long-term strategy outside the public markets.

Fortnox’s board of directors has unanimously recommended that shareholders accept the offer.

Deal No. 4:

Siemens AG to Acquire GraphPad Software, LLC dba Dotmatics for USD 5.10 Billion

In a strategic move to expand its AI-driven software capabilities into the life sciences sector, Siemens has announced its planned acquisition of Dotmatics, a provider of scientific R&D software, for USD 5.1 billion.

Dotmatics offers a comprehensive software platform designed to unify science, data, and decision-making across the R&D lifecycle. Its solutions enable researchers in biology, chemistry, and related fields to capture, analyze, visualize, and share data efficiently—enhancing collaboration and accelerating scientific breakthroughs. The company serves a broad range of pharmaceutical, biotech, and academic institutions, aiming to streamline workflows and improve research outcomes.

The acquisition will bolster Siemens’ position in industrial software by integrating AI-powered Product Lifecycle Management (PLM) capabilities into life sciences. This move is expected to increase Siemens’ industrial software total addressable market by USD 11 billion and supports its ONE Tech Company growth strategy, which aims to drive innovation across industries with the highest R&D investments.

Life sciences is one of the fastest-growing, innovation-intensive sectors, and this acquisition positions both companies to capitalize on that momentum. By combining Siemens’ industrial expertise, simulation technologies, and AI capabilities with Dotmatics’ specialized scientific tools, the deal establishes a unique, end-to-end digital ecosystem that bridges the gap between scientific discovery and commercial manufacturing in life sciences.

The transaction is subject to customary closing conditions and regulatory approvals. Evercore acted as the exclusive financial advisor to Dotmatics.

Deal No. 5:

LPL Holdings, Inc. to Acquire Commonwealth Financial Network for USD 2.70 Billion

LPL Financial, the largest independent broker-dealer in the United States, has entered into an agreement to acquire Commonwealth Financial Network, the nation’s leading privately held, independent Registered Investment Adviser, in an all-cash transaction valued at USD 2.7 billion.

Commonwealth supports approximately 2,900 independent financial advisors across the U.S. and manages over USD 285 billion in brokerage and advisory assets. The firm has earned a stellar reputation for advisor satisfaction, winning 11 consecutive first-place J.D. Power awards in this category.

This acquisition will enable LPL Financial to expand its presence among independent financial advisors and reinforce its position as one of the most advisor-focused firms in the industry.

With a network of nearly 29,000 advisors and USD 1.7 trillion in brokerage and advisory assets, LPL’s acquisition of Commonwealth represents a strategic integration aimed at enhancing the advisor experience and redefining the relationship between independence and support within the financial services industry.

The transaction is anticipated to close in the second half of 2025.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of March 31 to April 6, 2025. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter