- M&A News

M&A News: Global M&A Deals Week of May 12 to 18, 2025

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

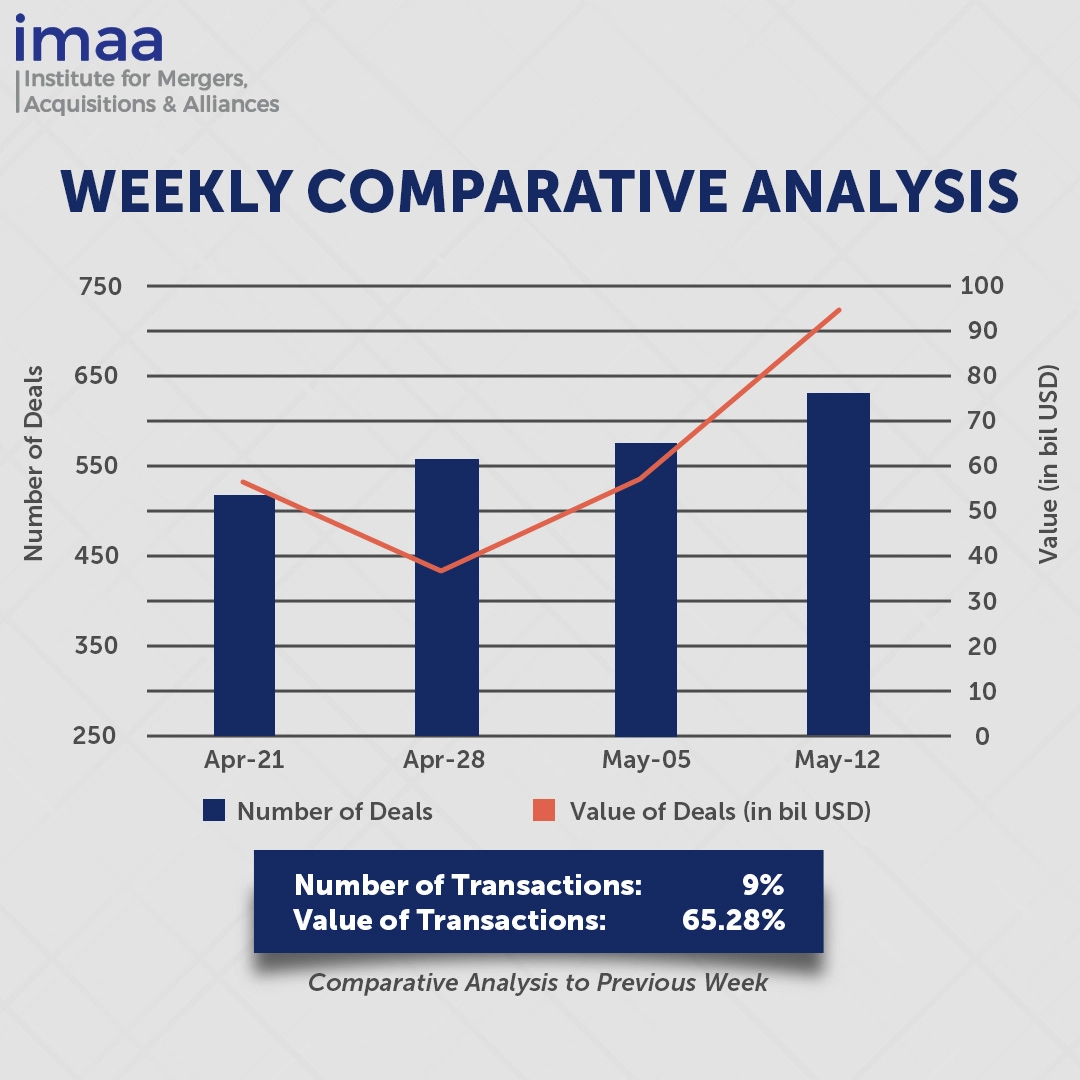

Between May 12 and May 18, the mergers and acquisitions (M&A) landscape saw a notable upswing, with 637 deals announced totaling USD 94.28 billion in aggregate value. Of these, 27 transactions individually exceeded USD 500 million, collectively accounting for USD 83.42 billion—roughly 88% of the week’s total deal value.

The most significant deal was Charter Communications’ USD 34.5 billion acquisition of Cox Communications. This merger aims to create a stronger contender in the broadband and mobile communications industry, responding to evolving market dynamics such as the shift from traditional cable to streaming services, increased competition from Big Tech in digital advertising, and the expansion of wireless providers into internet service offerings. Charter, currently the second-largest U.S. cable provider with over 30 million customers, will combine forces with Cox’s 6.5 million subscribers. Together, they plan to enhance innovation and deliver competitively priced, high-quality products to consumers.

Comparing this week’s data to the prior week, deal volume increased by 9%, from 582 to 637 deals, indicating sustained activity in the M&A space. More strikingly, the total deal value rose by 65%, jumping from USD 57.05 billion to USD 94.28 billion, driven primarily by the Charter-Cox transaction.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of May 12 to 18, 2025 in detail:

Deal No. 1: Charter Communications, Inc. to Acquire Cox Communications, Inc. for USD 34.50 Billion

Deal No. 2: NRG Energy, Inc. to Acquire LS Power’s Portfolio of Natural Gas Generation Facilities and CPower, Inc. for USD 12.00 Billion

Deal No. 3: DICK’S Sporting Goods, Inc. to Acquire Foot Locker, Inc. for USD 2.40 Billion

Deal No. 4: Primary Health Properties Plc to Acquire Assura Plc for USD 2.23 Billion

Deal No. 5: GSK plc to Acquire Efimosfermin alfa drug of Boston Pharmaceuticals for USD 2.00 Billion

Deal No. 1:

Charter Communications, Inc. to Acquire Cox Communications, Inc. for USD 34.50 Billion

Charter Communications is set to acquire Cox Communications in a transaction valued at USD 34.5 billion, bringing together two of the largest cable operators in the United States.

Cox Communications, a privately held company based in Atlanta, delivers broadband internet, television, phone, and smart home services to roughly 7 million residential and business customers across 18 states. The company has steadily invested in expanding its fiber infrastructure and enhancing its service offerings through advanced technology.

The merger will create a leading provider in broadband, mobile, and video services, with a strong emphasis on network reliability and customer experience. With a combined customer base exceeding 37 million, the new entity will be better positioned to compete in the rapidly evolving communications landscape and support sustained investment in next-generation technologies.

As part of the agreement, the combined company will assume roughly USD 12 billion of Cox’s outstanding debt.

Within one year of closing, the merged company will adopt the Cox Communications name. Additionally, Charter plans to extend its Spectrum News coverage into Cox’s markets, increasing access to local news content.

The deal is subject to standard regulatory and closing conditions. Citi and LionTree are advising Charter on the transaction, while BDT & MSD Partners, Evercore, and Wells Fargo are acting as financial advisors to Cox Communications.

Deal No. 2:

NRG Energy, Inc. to Acquire LS Power's Portfolio of Natural Gas Generation Facilities and CPower, Inc. for USD 12.00 Billion

NRG Energy has agreed to acquire LS Power’s portfolio of natural gas power plants and CPower, a commercial and industrial (C&I) virtual power plant (VPP) platform. The transaction, consisting of cash and stock, is valued at approximately USD 12 billion.

The deal includes 18 natural gas power facilities located across nine states, with a combined capacity of about 13 gigawatts (GW). Additionally, CPower contributes nearly 6 GW of flexible capacity, serving over 2,000 commercial and industrial customers across all deregulated energy markets in the United States.

This acquisition will double NRG’s generation capacity to 25 GW by incorporating modern, flexible natural gas assets that provide rapid start-up capabilities—particularly valuable in the Northeast and Texas markets. These facilities are expected to enhance NRG’s operational agility, improve customer service, simplify risk management, and reduce overall costs.

Furthermore, the deal strengthens NRG’s ability to meet growing demand for customized, long-term energy supply solutions, especially from data center clients. Following the acquisition, NRG projects an increase in its adjusted earnings per share (EPS) compound annual growth rate (CAGR) to at least 14%, up from the current target of 10%.

The transaction is expected to close in the first quarter of 2026. Citi and Goldman Sachs & Co. LLC are acting as NRG’s primary M&A advisors. For LS Power, Evercore leads the financial advisory team, supported by J.P. Morgan, Morgan Stanley & Co. LLC, and Solomon Partners Securities, LLC.

Deal No. 3:

DICK'S Sporting Goods, Inc. to Acquire Foot Locker, Inc. for USD 2.40 Billion

Foot Locker, a specialty retailer of athletic footwear and apparel, is being acquired by Dick’s Sporting Goods in a transaction valued at USD 2.4 billion. This deal unites two established players in the sports retail sector, creating a global platform with expanded presence across both U.S. and international markets.

Headquartered in New York City, Foot Locker operates more than 2,400 stores across over 20 countries, including locations in North America, Europe, Asia, Australia, and New Zealand. The company owns several well-known retail brands—such as Foot Locker, Kids Foot Locker, Champs Sports, Eastbay, and WSS—and partners with leading sportswear companies like Nike, Adidas, and Puma to serve athletes, sneaker enthusiasts, and younger consumers.

This acquisition enables Dick’s to enter international markets for the first time while enhancing its domestic presence through Foot Locker’s complementary store network. Together, the combined company plans to reach a broader customer base through diverse retail concepts and enhanced digital and in-store experiences.

The merger is expected to boost relationships with global brand partners by increasing exposure and offering more sales channels. Dick’s aims to invest in Foot Locker’s growth and anticipates up to USD 125 million in cost savings from improved procurement. The transaction should contribute to earnings in the first full fiscal year after closing.

Foot Locker will continue to operate as a standalone business unit within DICK’S portfolio, retaining its existing brands.

The acquisition is expected to be finalized in the second half of 2025. Goldman Sachs is advising Dick’s and providing committed bridge financing, while Evercore is acting as financial advisor to Foot Locker.

Deal No. 4:

Primary Health Properties Plc to Acquire Assura Plc for USD 2.23 Billion

Primary Health Properties (PHP), a UK-based real estate investment trust (REIT), has submitted a cash-and-stock offer valued at GBP 1.68 billion (USD 2.23 billion) to acquire Assura Plc, outbidding offers from U.S. investment firms KKR and Stonepeak.

Assura Plc, also a UK REIT, owns and operates a portfolio of over 600 healthcare facilities across the UK and Ireland, including GP clinics and diagnostic centers. Most of its properties are leased to the National Health Service (NHS). The company is part of the FTSE 250 Index and has committed to achieving net-zero carbon emissions by 2040 as part of its broader sustainability goals.

PHP’s proposal aims to combine two complementary portfolios, forming a larger and more liquid platform well-positioned to capitalize on the growing demand for primary healthcare infrastructure in the UK.

Combining PHP’s 516 properties with Assura’s portfolio of over 600 assets will form a GBP 6 billion portfolio of long-term leased, sustainable healthcare facilities primarily rented to government tenants and leading healthcare providers. PHP projects that the merger could deliver around GBP 9 million in annual cost savings while improving operational efficiency and supporting future growth.

Should the deal proceed, Assura shareholders would own about 48% of the newly combined business, subject to full acceptance of the offer.

Deal No. 5:

GSK plc to Acquire Efimosfermin alfa drug of Boston Pharmaceuticals for USD 2.00 Billion

GSK is acquiring Boston Pharmaceuticals’ lead asset, efimosfermin, in a transaction valued at up to USD 2 billion. The agreement includes an upfront payment of USD 1.2 billion, with an additional USD 800 million contingent on future development and regulatory milestones.

Efimosfermin is a Phase III–ready candidate being developed for the treatment and prevention of steatotic liver disease (SLD), a condition with limited therapeutic options that affects up to 5% of the global population.

Also referred to as efimosfermin alfa or BOS-580, the drug is a long-acting analogue of fibroblast growth factor 21 (FGF21) and is administered through a once-monthly subcutaneous injection. It is designed to regulate metabolic activity in the liver, with the goal of reducing fat buildup, controlling inflammation, and potentially reversing fibrosis.

The acquisition aligns with GSK’s research and development priorities, particularly its focus on immunology and fibrotic diseases. It supports the company’s strategy to advance precision therapies aimed at halting or reversing disease progression. Efimosfermin further strengthens GSK’s hepatology portfolio, which targets both viral liver diseases, such as chronic hepatitis B, and metabolic conditions like SLD.

The transaction is subject to customary closing conditions. Evercore Partners International LLP is serving as exclusive financial advisor to GSK, while Centerview Partners LLC is advising Boston Pharmaceuticals.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of May 12 to 18, 2025. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter