- M&A News

M&A News: Global M&A Deals Week of May 19 to 25, 2025

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

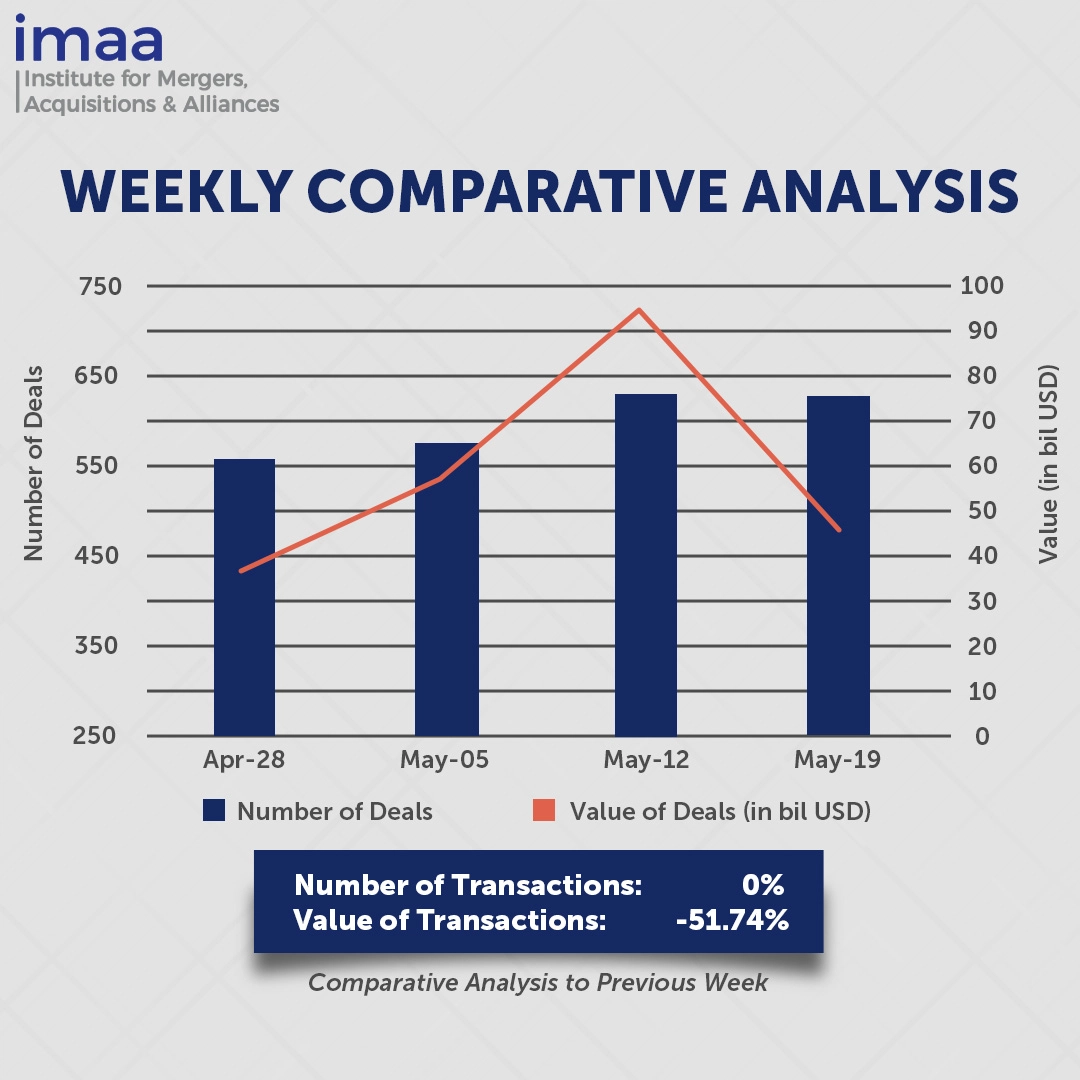

From May 19 to May 25, the mergers and acquisitions (M&A) market recorded 636 announced deals totaling USD 45.5 billion. Notably, 12 transactions each exceeded USD 500 million, together representing USD 35.67 billion—or 78% of the total deal value for the week.

The week’s largest transaction was Blackstone’s USD 11.5 billion acquisition of TXNM Energy, the parent company of regulated electric utilities PNM and TNMP operating in New Mexico and Texas. The deal is expected to provide critical long-term capital to support infrastructure upgrades, grid modernization, and the advancement of clean energy initiatives in both states. As a global investment firm with a strong focus on long-duration capital deployment, Blackstone has emphasized its commitment to supporting essential service providers that contribute to economic resilience and sustainable growth. The acquisition aligns with Blackstone’s strategy of investing in energy transition and infrastructure assets that offer stable returns while delivering long-term benefits to local communities and the environment.

Week-over-week data indicates that the volume of deals remained stable, with a marginal decline from 637 to 636. However, the total deal value experienced a significant drop of nearly 52%, falling from USD 94.29 billion to USD 45.5 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of May 19 to 25, 2025 in detail:

Deal No. 1: Blackstone Inc. to Acquire TXNM Energy, Inc. for USD 11.50 Billion

Deal No. 2: OpenAI, L.L.C. to Acquire io Products, Inc. for USD 6.50 Billion

Deal No. 3: AT&T Inc. to Acquire substantially all of Mass Markets fiber internet connectivity business of Lumen Technologies, Inc. for USD 5.75 Billion

Deal No. 4: Sanmina Corporation to Acquire Data Center Infrastructure Manufacturing Business of ZT Group Intl, Inc. for USD 3.00 Billion

Deal No. 5: Honeywell International Inc. to Acquire Johnson Matthey’s Catalyst Technologies business for USD 2.40 Billion

Deal No. 1:

Blackstone Inc. to Acquire TXNM Energy, Inc. for USD 11.50 Billion

Blackstone Infrastructure has agreed to acquire TXNM Energy in a transaction valued at USD 11.5 billion, including debt and preferred equity. The deal aims to provide substantial capital to TXNM Energy’s regulated utility subsidiaries—Public Service Company of New Mexico (PNM) and Texas-New Mexico Power (TNMP)—to support the expansion of electric infrastructure and accelerate clean energy programs.

TXNM Energy, through PNM and TNMP, provides electricity to approximately 800,000 customers across New Mexico and Texas. Its energy mix includes coal, natural gas, nuclear, solar, and wind resources, with a total generation capacity of about 2.7 gigawatts. PNM is reshaping its generation portfolio to align with New Mexico’s clean energy targets, while TNMP is increasing investments to meet surging electricity demand in high-growth areas of Texas.

Under the terms of the agreement, the current leadership at TXNM Energy, PNM, and TNMP will remain in place, with operations continuing in their respective service areas. Blackstone plans to fund the transaction entirely with equity and does not intend to increase TXNM Energy’s debt to finance the acquisition.

In addition to the purchase, Blackstone will inject USD 400 million into TXNM Energy through a private placement of 8 million newly issued shares priced at USD 50 each. TXNM Energy also plans to raise an additional USD 400 million in equity prior to the deal’s closing.

The acquisition is expected to close in the second half of 2026, pending regulatory and shareholder approvals. Wells Fargo is acting as the lead financial advisor to TXNM Energy, supported by Citi. RBC Capital Markets is serving as lead financial advisor to Blackstone, with additional advisory support from J.P. Morgan.

Deal No. 2:

OpenAI, L.L.C. to Acquire io Products, Inc. for USD 6.50 Billion

OpenAI is set to acquire io Products Inc., a startup specializing in AI-driven hardware, co-founded by former Apple design chief Jony Ive, in an all-stock transaction valued at USD 6.5 billion. This acquisition represents OpenAI’s largest to date and will bring Ive, who is known for designing influential Apple products such as the iPhone and iPad, into a key creative position focused on developing next-generation AI hardware.

The deal will create a new hardware division within OpenAI, merging its advanced artificial intelligence technology with the design and engineering skills of Ive and his team of approximately 55 experts. This group consists of engineers, researchers, and product developers who have contributed to well-known Apple devices including the iPhone, iPad, MacBook, and Apple Watch. Ive’s design firm, LoveFrom, will remain independent while supporting design strategy efforts for both OpenAI and io Products.

By integrating io Products, OpenAI aims to develop AI-native devices that offer more intuitive and seamless interaction with tools like ChatGPT. This move aligns with CEO Sam Altman’s long-term vision of embedding AI more deeply into daily life through dedicated hardware.

OpenAI already holds a 23% stake in io Products from a prior investment. The transaction is expected to close in the summer of 2025, pending regulatory approvals.

Deal No. 3:

AT&T Inc. to Acquire substantially all of Mass Markets fiber internet connectivity business of Lumen Technologies, Inc. for USD 5.75 Billion

AT&T, a major telecommunications company, is acquiring the majority of Lumen’s Mass Markets fiber business for USD 5.75 billion in cash. This strategic acquisition is intended to accelerate the rollout of high-speed fiber internet to millions of homes and businesses across the United States.

The Lumen Mass Markets fiber assets include approximately 1 million subscribers spanning over 4 million locations. This transaction will enable AT&T to strengthen its presence in key metropolitan areas such as Denver, Las Vegas, Minneapolis-St. Paul, Phoenix, Salt Lake City, and Seattle, among others.

AT&T aims to extend its fiber reach to about 60 million locations nationwide by the end of 2030, further solidifying its leadership in the fiber broadband sector.

Following the deal’s completion, Lumen will provide support under multiple transitional service agreements expected to last for approximately two years. These arrangements will cover critical functions such as field operations, IT systems, customer support, billing, and network deployment to facilitate a seamless transition.

The acquisition is expected to close in the first half of 2026. Upon closing, AT&T will hold the newly acquired fiber infrastructure and deployment capabilities through a newly formed, wholly owned subsidiary named NetworkCo. Goldman Sachs & Co. LLC and J.P. Morgan Securities LLC are advising Lumen on the transaction.

Deal No. 4:

Sanmina Corporation to Acquire Data Center Infrastructure Manufacturing Business of ZT Group Intl, Inc. for USD 3.00 Billion

AMD is divesting the data center infrastructure manufacturing business of ZT Systems, a provider of hyperscale computing solutions, to Sanmina Corporation in a transaction valued at USD 3 billion in a mix of cash and stock. This move follows AMD’s USD 4.9 billion acquisition of ZT Systems, completed in March 2025.

ZT Systems’ infrastructure division specializes in the development and production of high-performance server systems tailored for cloud computing and artificial intelligence workloads. With operations in the United States and Europe, it offers full-rack configurations and incorporates advanced technologies such as liquid cooling to enhance energy efficiency and scalability in large-scale data center environments.

Sanmina’s acquisition is expected to significantly expand its capabilities in the cloud and AI hardware markets. By combining Sanmina’s global reach and vertically integrated operations with ZT Systems’ expertise in hyperscale infrastructure, the company aims to better serve cloud providers and strengthen its position in the AI ecosystem.

Under the terms of the agreement, AMD will retain ZT’s AI systems design and customer support teams while forming a strategic partnership with Sanmina to co-develop and manufacture AI hardware solutions for cloud service providers.

The transaction is expected to close by the end of 2025. Foros acted as Sanmina’s financial advisor, with BofA Securities providing financing support. Morgan Stanley & Co. LLC served as AMD’s exclusive financial advisor.

Deal No. 5:

Honeywell International Inc. to Acquire Johnson Matthey's Catalyst Technologies business for USD 2.40 Billion

Johnson Matthey has reached an agreement to sell its Catalyst Technologies business to U.S. industrial leader Honeywell for GBP 1.8 billion (approximately USD 2.4 billion).

The Catalyst Technologies division develops advanced catalysts and process solutions that support sustainable chemical production across the energy, chemical, and transportation industries. Its portfolio includes technologies for sustainable aviation fuel, blue hydrogen, ammonia, methanol, and products used in refining and petrochemical sectors. In addition to technology licensing and engineering services, the division leads over 150 projects focused on accelerating the global transition to net-zero emissions.

This acquisition expands Honeywell’s capabilities as a leading technology provider of critical energy solutions, enhancing its ability to integrate process technologies with automation through its UOP business unit. Upon completion, Honeywell will broaden its product offerings to include sustainable methanol, SAF, blue hydrogen, and blue ammonia—strengthening its position in the evolving market for lower-emission fuels.

The deal is anticipated to be earnings accretive from the first year, adding high-growth opportunities to Honeywell’s Energy and Sustainability Solutions (ESS) segment.

For Johnson Matthey, the sale marks a shift toward a more focused business centered on Clean Air technologies and platinum group metals (PGMs), aimed at driving consistent cash flow and delivering sustained value to shareholders.

The transaction is expected to close in the first half of 2026, subject to customary regulatory approvals.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of May 19 to 25, 2025. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter