- M&A News

M&A News: Global M&A Deals Week of May 26 to June 1, 2025

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

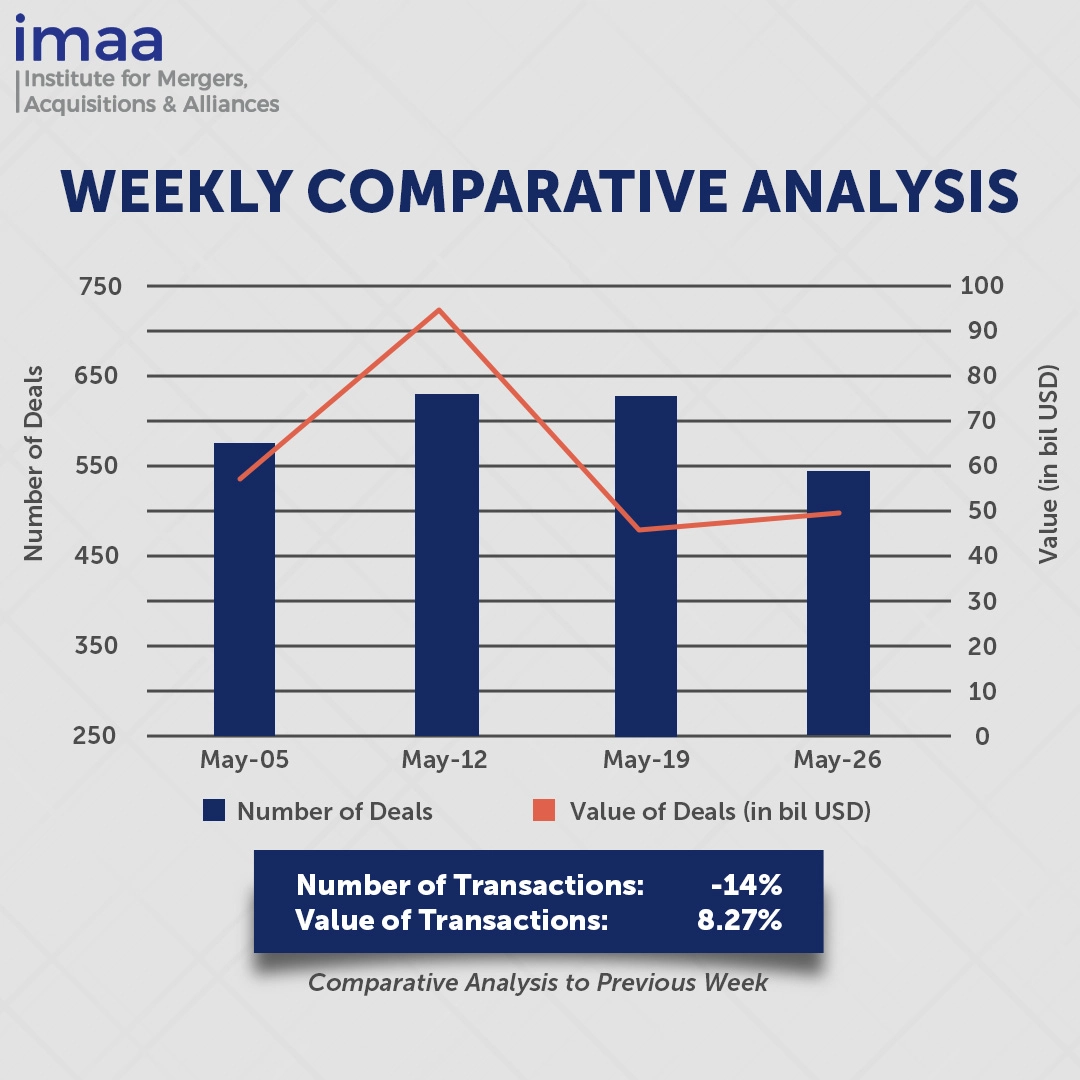

During the week of May 26 to June 1, the mergers and acquisitions (M&A) landscape recorded 550 announced deals, with a total disclosed value of USD 49.27 billion. Sixteen deals exceeded the USD 500 million mark, contributing a combined USD 39.35 billion—around 80% of the week’s total.

The top deal during this period was Salesforce’s USD 8 billion acquisition of Informatica, marking a significant move in its broader artificial intelligence strategy. The deal aims to enhance Salesforce’s data infrastructure to support agentic AI systems—autonomous tools that act on behalf of users—by integrating Informatica’s capabilities in data integration, quality, governance, and automation into its Data Cloud and Agentforce platform. In addition to advancing its AI roadmap, the acquisition strengthens Salesforce’s enterprise software portfolio through the addition of Informatica’s cloud-native data management solutions, enabling the delivery of real-time, trusted data pipelines essential for deploying next-generation AI tools in complex business environments.

Despite a 14% week-over-week decline in deal volume (from 636 to 550), overall deal value rose by 8% to USD 49.27 billion, up from USD 45.5 billion in the previous week.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of May 26 to June 1, 2025 in detail:

Deal No. 1: Salesforce, Inc. to Acquire Informatica Inc. for USD 8.00 Billion

Deal No. 2: EOG Resources, Inc. to Acquire Encino Acquisition Partners LLC for USD 5.60 Billion

Deal No. 3: Motorola Solutions, Inc. to Acquire Silvus Technologies, Inc. for USD 4.40 Billion

Deal No. 4: GATX Corporation; Brookfield Infrastructure Partners L.P. to Acquire Rail Assets of Wells Fargo & Company for USD 4.40 Billion

Deal No. 5: NTT DOCOMO, INC. to Acquire SBI Sumishin Net Bank, Ltd. for USD 2.90 Billion

Deal No. 1:

Salesforce, Inc. to Acquire Informatica Inc. for USD 8.00 Billion

CRM software provider Salesforce has announced its plan to acquire Informatica, a prominent provider of enterprise cloud data management solutions powered by AI, in an all-equity deal valued at approximately USD 8 billion. The acquisition underscores Salesforce’s commitment to expanding its AI and data infrastructure capabilities across its product suite.

Informatica specializes in cloud-native data management, offering tools that enable organizations to integrate, govern, and secure data across complex environments, including hybrid and multi-cloud systems. Its platform supports critical functions such as data quality, privacy, and metadata management, helping enterprises unlock the full value of their data for analytics, AI, and digital transformation.

By bringing Informatica into its ecosystem, Salesforce aims to reinforce the data foundation necessary for building and deploying scalable, responsible agentic AI. The integration will combine Informatica’s comprehensive offerings—including data integration, governance, metadata intelligence, and Master Data Management (MDM)—with Salesforce’s platform to create a unified architecture that allows AI agents to operate securely and effectively across the enterprise.

Following the acquisition, Salesforce intends to embed Informatica’s capabilities within its Agentforce platform and Data Cloud, creating a streamlined data pipeline and a shared system of intelligence that enhances AI-powered customer experiences. The company also plans to support Informatica’s partner network and accelerate its cloud business growth through Salesforce’s robust marketing and distribution channels.

The transaction is expected to close in the early part of Salesforce’s fiscal year 2027. J.P. Morgan Securities LLC is advising Salesforce, while Goldman Sachs & Co. LLC is acting as the exclusive financial advisor to Informatica.

Deal No. 2:

EOG Resources, Inc. to Acquire Encino Acquisition Partners LLC for USD 5.60 Billion

EOG Resources is set to acquire Encino Acquisition Partners (EAP) in a transaction valued at USD 5.6 billion, including debt, positioning EOG as a dominant player in the Utica Shale exploration and production sector.

Encino Acquisition Partners is an oil and gas operator focused on acquiring and developing high-potential E&P assets in mature U.S. basins. With a strategic emphasis on operational efficiency and resource optimization, Encino maintains a strong presence in key shale regions, including the Utica Shale, leveraging expert asset management and execution to enhance value and support growth.

The deal adds 675,000 net acres to EOG’s Utica Shale position, bringing its total to about 1.1 million net acres. This expands EOG’s overall resource portfolio to more than 12 billion barrels of oil equivalent (boe) and lifts daily production in the region to 275,000 boe. Financially, the acquisition is expected to grow EOG’s 2025 EBITDA by 10% and free cash flow by 9%, while also boosting net asset value and per-share performance.

The acquisition is anticipated to close in the second half of 2025. EOG intends to finance the deal with USD 3.5 billion in debt and USD 2.1 billion in cash. Goldman Sachs & Co. LLC is acting as EOG’s exclusive financial advisor.

Deal No. 3:

Motorola Solutions, Inc. to Acquire Silvus Technologies, Inc. for USD 4.40 Billion

Motorola Solutions is acquiring Silvus Technologies for an upfront payment of USD 4.4 billion, enhancing its capabilities in mission-critical communications amid growing demand for resilient systems capable of operating in contested environments.

Silvus Technologies, based in Los Angeles, specializes in advanced wireless communication solutions designed for mission-critical applications. Known for its Mobile Networked MIMO (MN-MIMO) technology, Silvus develops mesh networking systems that deliver reliable, high-speed connectivity in complex and challenging conditions. Its flagship StreamCaster radios are widely adopted by military, law enforcement, and public safety organizations, supporting secure communications across land, air, and maritime operations.

With over two decades of research and development, Silvus has built a suite of complementary technologies and sophisticated software algorithms that optimize MANET (Mobile Ad Hoc Network) performance. These innovations maximize data throughput and network connectivity, reduce vulnerability to jamming, and minimize detection and interception risks.

The acquisition will combine Motorola’s extensive go-to-market reach with Silvus’s engineering expertise to expand their global customer base.

The deal is expected to close in the third or fourth quarter of 2025. Additionally, Silvus may earn up to USD 600 million in performance-based earnouts over consecutive twelve-month periods through 2027 and 2028.

Deal No. 4:

GATX Corporation; Brookfield Infrastructure Partners L.P. to Acquire Rail Assets of Wells Fargo & Company for USD 4.40 Billion

Wells Fargo has agreed to sell its railcar leasing assets to a newly established joint venture between GATX Corporation and Brookfield Infrastructure in a transaction valued at USD 4.4 billion.

The deal includes Wells Fargo’s operating lease portfolio of approximately 105,000 railcars, primarily freight cars (95%) spanning a wide range of car types. The fleet is currently operating at about 97% utilization, reflecting strong demand and asset quality. Separately, Brookfield Infrastructure will directly acquire Wells Fargo’s rail finance-lease portfolio, consisting of roughly 23,000 railcars and approximately 440 locomotives.

Under the terms of the joint venture, Brookfield Infrastructure will hold a 70% equity stake while GATX will own 30%, with GATX having the option to gradually increase its ownership to 100%. GATX will manage both the railcars within the joint venture and the finance-lease railcars and locomotives owned directly by Brookfield Infrastructure.

GATX’s global asset base includes tank and freight railcars, commercial aircraft spare engines, and tank containers. This acquisition will further diversify GATX’s fleet and enhance its ability to serve customers across various sectors.

For Wells Fargo, this sale aligns with its ongoing strategy to simplify operations and focus on core products and services that support its clients.

The deal is expected to close by the first quarter of 2026 or sooner. BofA Securities served as the sole financial advisor to GATX and Brookfield Infrastructure, while Wells Fargo Securities, LLC was the exclusive financial advisor to Wells Fargo.

Deal No. 5:

NTT DOCOMO, INC. to Acquire SBI Sumishin Net Bank, Ltd. for USD 2.90 Billion

NTT Docomo, a leading Japanese telecommunications company, plans to acquire a majority stake in SBI Sumishin Net Bank, a prominent Japanese online bank, for JPY 420 billion (USD 2.9 billion) as part of a strategic partnership with SBI Holdings.

Docomo will purchase nearly two-thirds of the bank’s shares, including the one-third currently owned by SBI Holdings, while Sumitomo Mitsui Trust Bank will retain the remaining one-third stake.

SBI Sumishin Net Bank was founded as a joint venture between SBI Holdings and Sumitomo Mitsui Trust Bank. It offers a wide range of digital banking services—such as deposit accounts, loans, and credit cards—to more than 4 million customers. The bank follows a “NEOBANK” strategy, partnering with various companies to embed banking services into multiple platforms, enhancing accessibility and customer experience.

This acquisition supports NTT Docomo’s goal to diversify beyond telecommunications and strengthen its economic ecosystem centered on the “d Point” rewards program. For SBI Sumishin Net Bank, the partnership is expected to expand its customer base, increase deposits, grow mortgage services through Docomo’s network, and advance its Banking-as-a-Service (BaaS) offerings.

Once the deal is complete, Docomo will hold 65.81% of the shares, Sumitomo Mitsui Trust Bank will hold 34.19%, and both firms will share equal voting rights, with 50% each.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of May 26 to June 1, 2025. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter