- M&A News

M&A News: Global M&A Deals Week of May 5 to 11, 2025

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

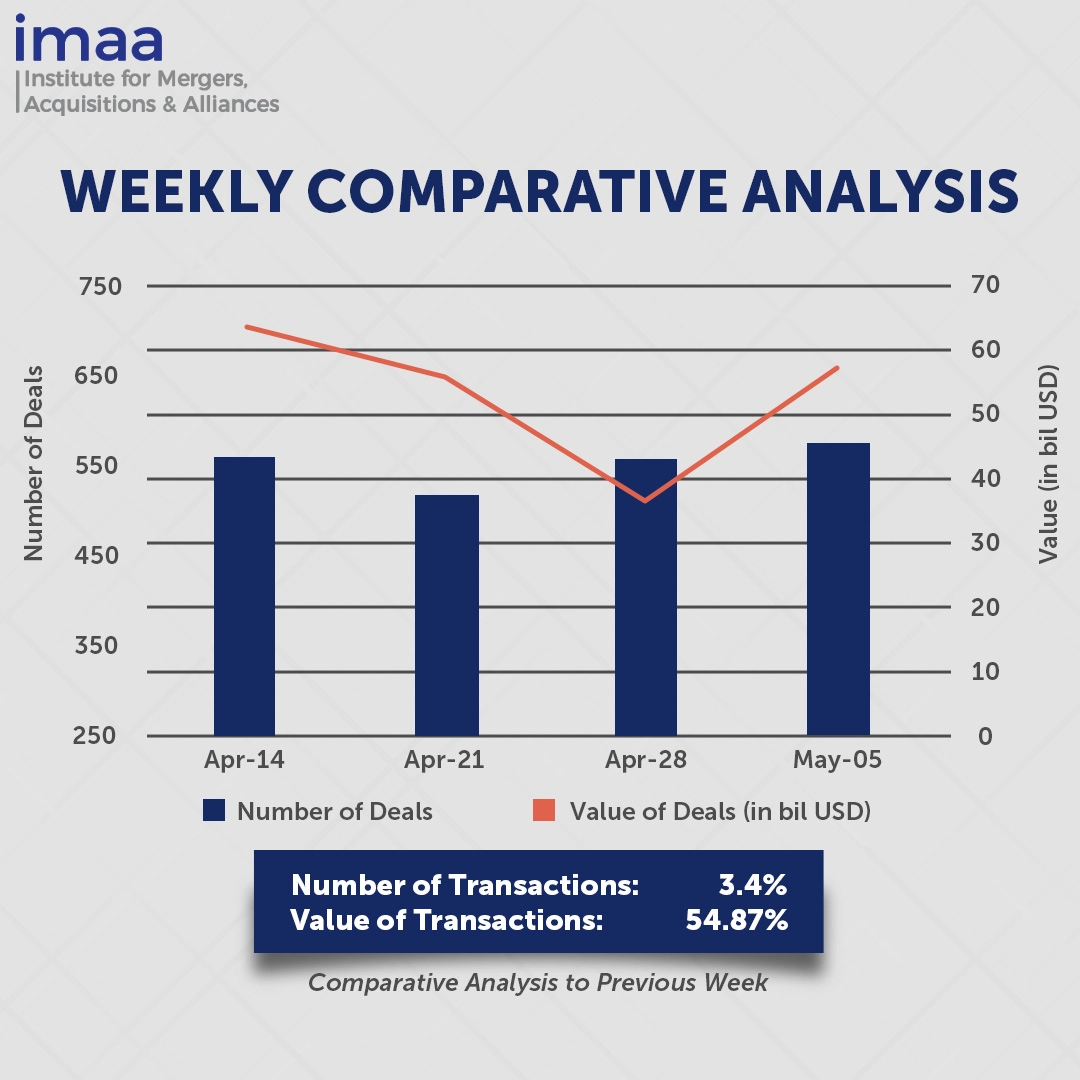

For the week of May 5 to May 11, the mergers and acquisitions (M&A) market saw a notable increase in activity, with 582 deals announced, totaling USD 57.05 billion in value. Of these, 22 transactions surpassed the USD 500 million threshold, accounting for 84% of the total deal value of the week, with a combined worth of USD 48.10 billion.

The standout deal of the week was 3G Capital’s USD 9.42 billion acquisition of Skechers USA, marking the largest buyout in the footwear industry to date. The move to take the company private comes amid heightened uncertainty over U.S. tariffs on foreign goods—a key concern for brands with globally integrated supply chains. China, in particular, represents a major source of imports for many U.S. consumer companies. Skechers, with over 5,300 retail locations and a presence in more than 180 countries via owned stores, third-party partners, and e-commerce channels, has held its ground against major players like Nike and rising challengers such as Hoka, due to its aggressive global expansion and value-driven approach.

Week-on-week, M&A activity showed a notable uptick, with deal volume increasing by 3% (from 563 to 582) and deal value surging by 55% (from USD 36.84 billion to USD 57.05 billion).

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of May 5 to 11, 2025 in detail:

Deal No. 1: 3G Capital, Inc. to Acquire Skechers U.S.A., Inc. for USD 9.42 Billion

Deal No. 2: Sunoco LP to Acquire Parkland Corporation for USD 9.10 Billion

Deal No. 3: Erste Group Bank AG to Acquire Santander Bank Polska Group S.A./Santander Towarzystwo Funduszy Inwestycyjnych S.A.

for USD 7.90 Billion

Deal No. 4: Coinbase Global, Inc. to Acquire Deribit FZE for USD 2.90 Billion

Deal No. 5: Geely Automobile Holdings Limited to Acquire ZEEKR Intelligent Technology Holding Limited for USD 2.20 Billion

Deal No. 1:

3G Capital, Inc. to Acquire Skechers U.S.A., Inc. for USD 9.42 Billion

Private equity firm 3G Capital is acquiring Skechers USA in a landmark transaction valued at USD 9.42 billion (USD 63 per share) in cash, marking the brand’s exit from the public market after 26 years. This deal comes as Skechers faces the challenges of high U.S. tariffs.

Skechers U.S.A., Inc. ranks as the third-largest footwear brand globally, recognized for its focus on comfort, affordability, and style. The brand serves a wide consumer base with its extensive range of casual, athletic, and work shoes. Through significant international growth and high-profile celebrity endorsements, Skechers has expanded its presence worldwide. In 2024, the company reached a record annual sales figure of over USD 9 billion, reflecting a 12.1% year-over-year growth.

This acquisition provides a strategic opportunity for Skechers to advance its position in both lifestyle and performance footwear. Analysts expect that 3G Capital’s proven approach of driving margin improvements and operational efficiencies could pave the way for the company to return to the public market in the long term.

The deal is expected to close in the third quarter of 2025. Upon completion, Skechers will be delisted from the New York Stock Exchange and transition into private ownership. J.P. Morgan Securities LLC acted as the exclusive financial advisor to 3G Capital, while Greenhill, a Mizuho affiliate, advised Skechers.

Deal No. 2:

Sunoco LP to Acquire Parkland Corporation for USD 9.10 Billion

Canada’s Parkland Corporation is set to be acquired by Sunoco in a deal valued at USD 9.1 billion, including debt, positioning the combined entity as the largest independent fuel distributor in the Americas.

Parkland is a major player in fuel distribution, marketing, and convenience retailing, operating around 4,000 locations across Canada, the U.S., and the Caribbean. The company operates under several well-known brands, including Ultramar, Esso, Chevron, Pioneer, and Fas Gas Plus. In addition to its retail network, Parkland provides commercial fuel distribution and wholesaling services and owns the Burnaby Refinery in British Columbia, which produces low-carbon fuels.

The acquisition will integrate Parkland’s 650 Canadian retail locations and 211 U.S. stores into Sunoco’s operations. The deal is expected to immediately boost earnings, with an anticipated 10% increase in distributable cash flow per common unit and USD 250 million in synergies by the third year. The combined entity will benefit from complementary assets, enhancing fuel supply efficiency and further diversifying Sunoco’s portfolio and geographic reach.

As part of the agreement, Sunoco will establish a new publicly traded entity, SUNCorp, LLC, with its headquarters remaining in Parkland’s home city of Calgary, Alberta.

The transaction is anticipated to close in the second half of 2025. Barclays and RBC Capital Markets are serving as exclusive financial advisors to Sunoco, while Goldman Sachs Canada Inc. and BofA Securities are advising Parkland.

Deal No. 3:

Erste Group Bank AG to Acquire Santander Bank Polska Group S.A./Santander Towarzystwo Funduszy Inwestycyjnych S.A.

for USD 7.90 Billion

Erste Group Bank, a prominent financial services provider based in Austria, has reached an agreement to acquire a 49% stake in Santander Bank Polska and a 50% stake in Santander TFI, an asset management firm managing EUR 6 billion in assets. The total value of the transaction is EUR 7 billion (USD 7.9 billion) in cash.

Santander Bank Polska, the third-largest bank in Poland by assets with over 8% market share, is also one of the country’s most profitable institutions. It offers a comprehensive range of banking services to retail, SME, and corporate clients. Through this acquisition, Erste Group will gain a significant foothold in the Polish market, solidifying its position as the leading lender in Central and Eastern Europe (CEE). With the addition of Santander Bank Polska, Erste Group’s loan book in the region is set to grow from EUR 94 billion to EUR 131 billion based on 2024 data.

Poland has experienced some of the highest real GDP growth in Europe over the last 25 years, and its banking sector remains underpenetrated compared to most other European markets. By acquiring a controlling stake in Santander Bank Polska, Erste Group is pursuing its strategic goal of becoming a dominant lender in CEE and expanding into one of Europe’s most dynamic and profitable banking markets. Additionally, Erste Group and Santander will engage in a strategic partnership to leverage each other’s strengths in Corporate & Investment Banking (CIB) and allow Erste access to Santander’s global payments infrastructure.

The deal is expected to boost Erste Group’s earnings per share (EPS) by over 20%, while its return on tangible equity (ROTE) is projected to reach 19% by 2026, up from the current market consensus of 15%.

The transaction is expected to close by the end of 2025, subject to customary regulatory approvals, including from the Polish Financial Supervision Authority (KNF) and anti-trust approval from the European Commission. J.P. Morgan SE is serving as financial advisor to Erste Group.

Deal No. 4:

Coinbase Global, Inc. to Acquire Deribit FZE for USD 2.90 Billion

Coinbase has announced its acquisition of Deribit, a Dubai-based global crypto options exchange, in a USD 2.9 billion deal aimed at establishing the most comprehensive global platform for crypto derivatives trading.

Deribit is recognized for its strong position in the cryptocurrency derivatives market, offering futures and options on major digital assets such as Bitcoin and Ethereum. The platform is widely used by both institutional and retail traders due to its deep liquidity, robust infrastructure, and advanced trading features. The platform’s wide range of high-leverage trading options makes it a go-to for experienced traders and newcomers alike.

This acquisition positions Coinbase as a global leader in crypto derivatives by open interest and options volume. Deribit, which traded over USD 1 trillion in volume across Bitcoin and other cryptocurrencies, currently holds approximately USD 30 billion in open interest. Deribit’s established institutional client base and international reach align with Coinbase’s broader strategy to scale its global operations. The combined capabilities will enable Coinbase to offer a more extensive suite of trading products—spanning spot, futures, perpetuals, and options—on a single trusted platform.

The transaction remains subject to regulatory approval and other customary closing conditions and is expected to be finalized by the end of the year.

Coinbase to Acquire Deribit: Becoming the Most Comprehensive Global Crypto Derivatives Platform

Coinbase Buys Derivatives Venue Deribit for $2.9 Billion

Coinbase to acquire major crypto derivatives platform Deribit for $2.9B – SiliconANGLE

Coinbase to buy options exchange Deribit in $2.9B deal | Banking Dive

Deal No. 5:

Geely Automobile Holdings Limited to Acquire ZEEKR Intelligent Technology Holding Limited for USD 2.20 Billion

Geely, the Chinese automotive group, plans to take Zeekr private by acquiring the remaining 34.3% stake it does not already own for USD 2.2 billion—just a year after Zeekr’s listing on the New York Stock Exchange.

Launched in 2021, Zeekr specializes in premium electric vehicles designed for performance, with models such as the Zeekr 001, 009, 007, and Zeekr X—all built on Geely’s Sustainable Experience Architecture (SEA) platform. While rooted in the Chinese market, Zeekr has been actively expanding its international footprint, targeting markets including Japan, Brazil, and Australia. The company delivered over 222,000 vehicles in 2024.

The buyout supports Geely’s broader strategy to streamline its EV operations reduce internal redundancies, and improve operational efficiency. Chairman Li Shufu noted that the integration supports Geely’s long-term objective of aligning technology development, supply chains, and global market initiatives under a cohesive framework.

This move also marks a strategic transition from aggressive expansion toward streamlined operations as Geely navigates intensifying global trade dynamics and disruption in the EV sector.

Chinese carmaker Geely offers to take Zeekr unit private in $2.2 bln deal | Reuters

Geely Bids to Take Zeekr Private at $6.4 Billion Valuation

Geely Offers $2.2B to Take Zeekr Private Amid EV Market Shake-Up – EconoTimes

Zeekr set to go private as Geely announces full acquisition of NYSE-listed EV unit

Geely Automobile to acquire full ownership of Zeekr in push to consolidate NEV business – Gasgoo

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of May 5 to 11, 2025. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter