- Uncategorized

DealRoom

DealRoom is a global database platform focused on fostering growth for startups and tech ecosystems by offering comprehensive data and insights on emerging companies and venture capital activities. It serves investors, entrepreneurs, and government organizations with tools such as startup databases, personalized dashboards, and predictive algorithms that highlight promising startups and scale-ups. Users receive tailored recommendations and notifications, while entrepreneurs can increase visibility by adding or claiming their business on the platform.

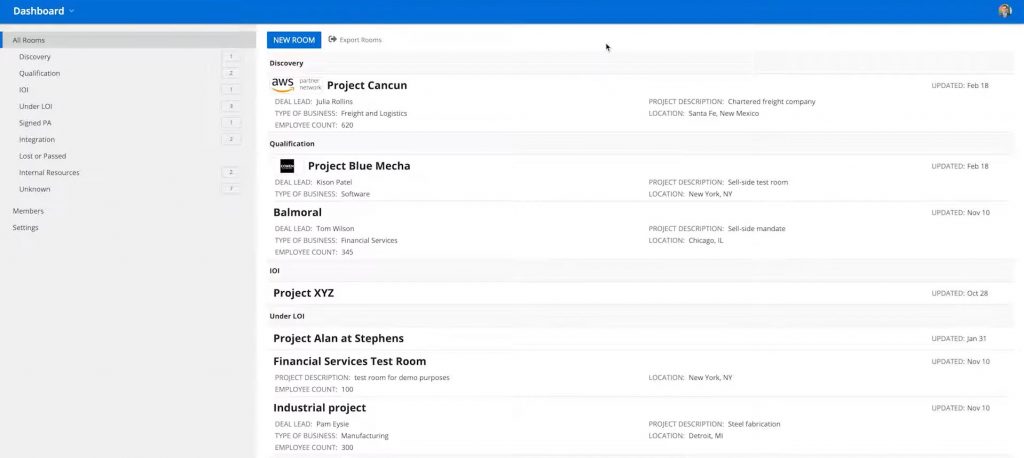

It stands as a comprehensive M&A Lifecycle Management Platform, designed to harmonize team priorities and unlock enhanced value. With a clear focus on optimizing M&A processes, it equips teams with an end-to-end software solution for both M&A and corporate development. From deal sourcing and diligence to integration and project management, DealRoom’s M&A platform encompasses the essential toolkit. Keep multiple deals organized in the pipeline while benefiting from features like Pipeline Management, Multi-deal timeline view, and robust reporting.

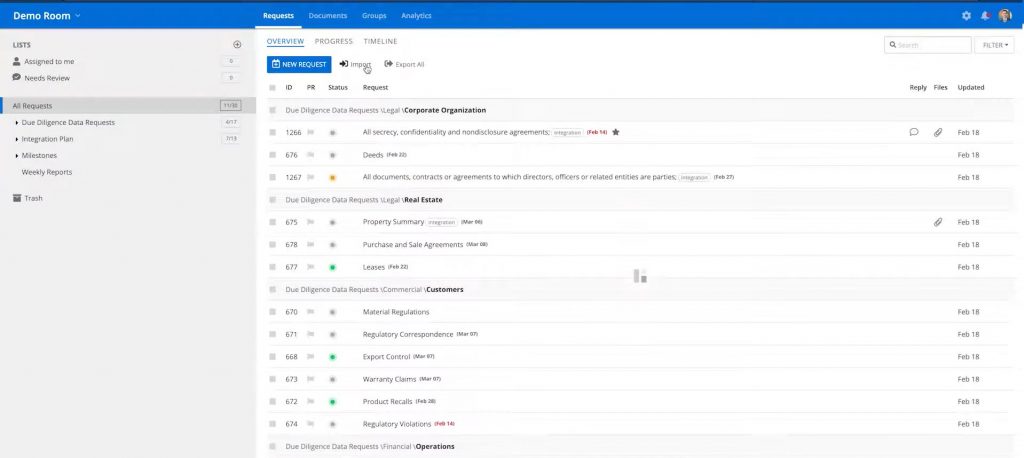

For diligence, streamline document storage and request completion through Diligence Management + VDR, Pre-Built Templates, and Reporting & Analytics. Prepare for post-close success with integration planning, synergy identification, and parallel tracking of Diligence & Integration workstreams. DealRoom’s capabilities extend to divestitures, aiding in the organization and management of business units during such transactions, backed by features like buyer-engagement tracking, secure file storage, and communication tools.

DealRoom’s all-in-one dashboard view showing all your M&A transactions and deals | Source: dealroom.net

DealRoom’s data request function which simplifies the process of storing data and uploading campaign files | Source: dealroom.net

Heading 2

Heading 3

Heading 4

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Stay up to date with M&A news!

Subscribe to our newsletter