- Blog

Top Global M&A Deals 2023: Software and IT Industry

SHARE:

Welcome to the Institute for Mergers, Acquisitions, and Alliances’ overview of the Top Global M&A Deals 2023: Software and Information Technology (IT) Industry. This is your essential guide to the most recent tech M&A deals that are shaping this fast-paced sector. From startups specializing in niche solutions in SaaS and cloud computing, to established tech giants expanding their portfolios into artificial intelligence and cybersecurity, our monthly report captures the transformative activity in a sector that forms the backbone of modern life.

In today’s digital age, the software and IT industry is a driving force behind global innovation. Companies rely heavily on technology to streamline operations, enhance customer experiences, and innovate. As companies strive to stay competitive and adapt to rapidly evolving technological landscapes, recent M&A deals in tech have emerged as key catalysts for growth.

The software and IT sector is not only about lines of code but also about the people, ideas, and solutions that shape our digital world. It includes enterprises that offer solutions ranging from data storage and management to network security, as well as those providing tools for machine learning, analytics, and business process automation. From cloud service providers to cybersecurity firms, data analytics companies to enterprise software developers, these organizations create the fabric of our digital ecosystem.

As you explore our 2023 report on the software and IT industry, you’ll discover a monthly breakdown of the recent tech M&A deals, offering insights into how the industry is adapting to the complex interplay of consumer preferences, technological advances, and market dynamics.

Whether you’re a seasoned industry professional, an investor, or simply interested in understanding the tech world, our platform offers you a front-row seat to the ongoing evolution of the software and IT industry through the lens of M&A.

July

- Deal 1: Worldpay Group Limited (United Kingdom) was acquired by GTCR LLC (United States) for $18.5 billion USD.

- Deal 2: New Relic, Inc. (United States) was acquired by TPG Capital, L.P. (United States); Francisco Partners Management, L.P. (United States) for $6.5 billion USD.

- Deal 3: Bolloré Logistics GIE (France) was acquired by CMA CGM S.A. (France) for $5.11 billion USD.

- Deal 4: Imperva, Inc. (United States) was acquired by Thales S.A. (France) for $3.6 billion USD.

- Deal 5: Cobham Aerospace SAS (France) was acquired by Thales S.A. (France) for $1.1 billion USD.

August

- Deal 1: Syntellis Performance Solutions, LLC (United States) was acquired by Strata Decision Technology, L.L.C. (United States) for $1.25 billion USD.

- Deal 2: Perimeter 81 Ltd. (Israel) was acquired by Check Point Software Technologies Ltd. (Israel) for $0.50 billion USD

- Deal 3: Blancco Technology Group plc (United Kingdom) was acquired by Francisco Partners Management, L.P. (United States) for $0.22 billion USD.

- Deal 4: Working Group Two AS (Norway) was acquired by Cisco Systems, Inc. (United States) for $0.15 billion USD.

- Deal 5: Immersed Inc. (United States) was acquired by Maquia Capital Acquisition Corporation (United States) for $0.15 billion USD.

September

- Deal 1: Splunk Inc. (United States) was acquired by Cisco Systems, Inc. (United States) for $28.00 billion USD.

- Deal 2: Telefónica, S.A. (Spain) was acquired by Saudi Telecom Company (Saudi Arabia) for $2.26 billion USD.

- Deal 3: PGS ASA (Norway) was acquired by TGS ASA (Norway) for $0.86 billion USD.

- Deal 4: Regional data centre business of Singapore Telecommunications Limited (Singapore) was acquired by KKR & Co. Inc. (United States) for $0.81 billion USD.

- Deal 5: Ermetic Ltd. (Israel) was acquired by Tenable Holdings, Inc. (United States) for $0.26 billion USD.

October

- Deal 1: EngageSmart, Inc. (United States) was acquired by Vista Equity Partners Management, LLC (United States) for $4.00 billion USD.

- Deal 2: SP Plus Corporation (United States) was acquired by Metropolis Technologies, Inc. (United States) for $1.50 billion USD.

- Deal 3: EA Elektro-Automatik Holding Gmbh (Germany) was acquired by Fortive Corporation (United States) for $1.45 billion USD.

- Deal 4: Cybersecurity, Intelligence and Services Business within Raytheon Segment of RTX Corporation (United States) was acquired by an undisclosed party for $1.30 billion USD.

- Deal 5: Loom, Inc. (United States) was acquired by Atlassian Corporation (United States) for $0.98 billion USD.

November

- Deal 1: Application Modernization and Connectivity business of OpenText was acquired by Rocket Software, Inc. (United States) for $2.28 billion USD.

- Deal 2: Talon Cyber Security Ltd. (Israel) was acquired by Palo Alto Networks, Inc. (United States) for $0.60 to $0.70 billion USD.

- Deal 3: EQS Group AG (Germany) was acquired by Thoma Bravo, L.P. (United States) for $0.43 billion USD.

- Deal 4: Corvus Insurance Holdings, Inc. (United States) was acquired by The Travelers Companies, Inc. (United States) for $0.43 billion USD.

- Deal 5: Q4 Inc. (Canada) was acquired by Sumeru Equity Partners, LP (United States) for $0.26 billion USD.

December

- Deal 1: Guangzhou JN Union Technology Co., Ltd. (China) was acquired by Sansec Technology Co., Ltd. (China) for $5.60 billion USD.

- Deal 2: Alteryx, Inc. (United States) was acquired by Insight Venture Management, LLC (United States), and Clearlake Capital Group, L.P. (United States) for $4.40 billion USD.

- Deal 3: WebMethods Germany webMethods Germany GmbH (Germany), and StreamSets, Inc. (United States) was acquired by International Business Machines Corporation (United States) for $2.30 billion USD.

- Deal 4: Hollysys Automation Technologies Ltd. (British Virgin Islands) was acquired by Ascendent Capital Partners (Asia) Limited (Hong Kong) for $1.66 billion USD.

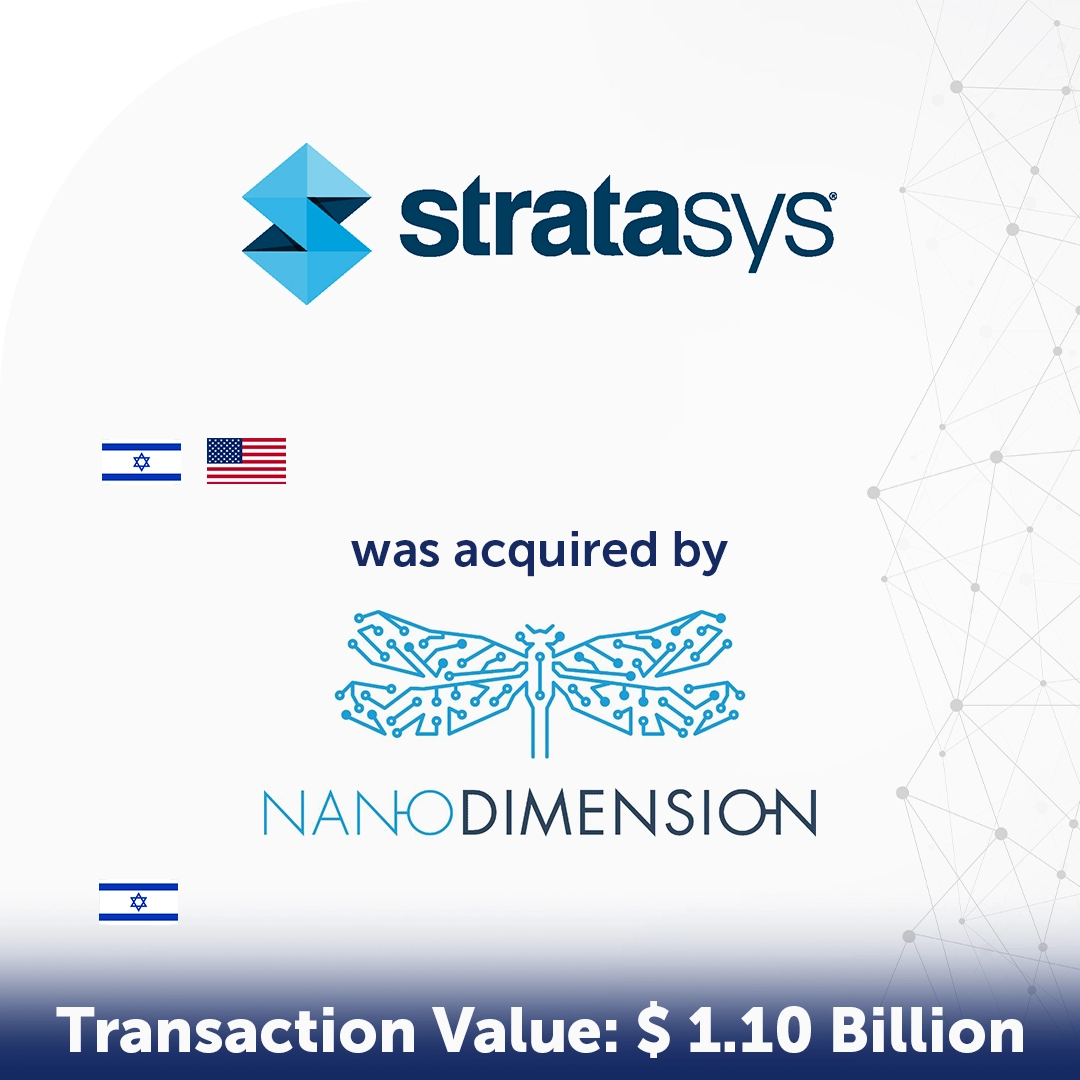

- Deal 5: Stratasys Ltd. (Israel & United States) was acquired by Nano Dimension Ltd. (Israel) for $1.10 billion USD.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter