Carve-Outs, Spin-Offs, and Divestitures Shaping the Future of M&A

Mergers and acquisitions, a staple in the business world, represent the consolidation of companies or assets, often aiming to achieve growth, enter new markets, or

Publications Mergers And Acquisitions: A Strategic Tool For Restructuring In The Indian Telecom Sector

SHARE:

Reforms implemented by Telecom Regulatory Authority of India (TRAI) and Department of Telecommunications (DoT) post liberalization have drastically altered the business environment in the Indian telecom sector. This sector has emerged as a significant performer in the Indian services domain. The telecom companies have opted for Mergers and Acquisitions (M&A) as a strategic tool to enhance their performances. The objective of this study is to explore the overall strategic impact of M&A in the telecom industry. Previous research has shown that M&As in the telecom sectors of USA and Europe have not been fruitful. In this paper, we have concentrated on 10 M&A deals in the BSE-listed Indian telecom companies during a timeframe spanning from 2000 to 2010 to determine the effect of M&As in this sector and how they have brought about changes, if any, in the business performance of the acquirer companies. The focus of our study is to measure the change in performance levels of the companies, if any, in the post merger phase as compared to the pre merger ones through selected HR and financial parameters like HCROI (Human Capital Return on Investment), Compensation of employees to PAT ratio, EPS (Earnings Per Share) and market share. The findings indicate a mixed outcome.

Mergers and acquisitions have been used as an effective strategic corporate restructuring tool in the business scenario worldwide for a long time dating back to 1897. They are effective tools in the hands of the management to achieve greater efficiency by exploiting synergies and growth opportunities.

The service industry forms the backbone of social and economic development of a country. Across the globe, the service sector has been playing a dominant role in the growth of economies. The service sector in India is highly dynamic and has grown to a considerable size, contributing to 56.5% in the GDP in 2012-13.

Telecommunications industry is one of the most profitable and rapidly developing industries in the world. According to the annual report 2012-13 published by DoT, Government of India, the Indian telecom sector has registered a phenomenal growth during the past few years and has become second largest telephone network in the world, after China. It is one of the few sectors in India which has witnessed the most fundamental structural and institutional reforms since 1991. Government policies and regulatory framework implemented by Telecom Regulatory Authority of India (TRAI) and Department of Telecommunications (DoT) have provided a conducive environment for service providers. This has made the sector more competitive. According to the information available in the annual report 2011-12 of TRAI, the telecom sector registered an impressive growth during the year. The number of telephone subscriptions increased from 846.32 million to 951.34 million, registering a growth of 12.41%. The number of mergers and acquisitions in Telecom Sector has been increasing significantly. The report by the Institute of Mergers, Acquisitions and Alliances (IMAA) has provided evidence about the number of mergers and acquisitions in Indian telecom sector over a period of twenty-eight years, ranging from 1985 to the first quarter of 2013. The report clearly shows that the phenomenon of merger and acquisition has gradually grown over the years, reporting a noticeable hike in the year 2000 with the transaction value around US$1300 billion. The transaction value for 2013 is around US$ 400 billion, reported till the first quarter. The first merger and acquisition deal in the Indian telecom industry occurred in 1998 between Max Group of Delhi and Hutchison Group of Hong Kong. The well-known mergers and acquisitions in the telecom sectors include acquisition of Command Cellular Services by Hutchison from Usha Martin, acquisition of stakes in Idea cellular by Aditya Birla group from the Tata group, merger of Aircel Ltd. with G T L Infrastructure Ltd, acquisition of Hutch services in India by Vodafone etc.

In this paper, we have concentrated on 10 M&A deals in the Indian telecom sector during a timeframe spanning from 2000 to 2010. The focus of our study is to measure the change in performance levels of the companies, if any, in the post merger phase as compared to the pre merger ones.

Academic interest in mergers and acquisitions was first recognized in the 1960s (Kitching, 1967) and there are innumerable studies focussing on the impact of such a phenomenon on the different financial parameters.

Khemani (1991) probed that the multiple forces that influence the decisions for engaging in M&A and deduced that profitability was the ultimate objective.

One of the primary motives behind any strategic corporate decision is to maximise shareholder value. Al-Sharkas et. al. (2010) focused on abnormal returns for bidder, target and combined firms in bank mergers. The outcomes revealed that overall announcements of bank mergers generated positive wealth effects for the combined shareholders.

Researches resembling the above mentioned studies were also conducted in India. The work of Rao and Rao (1987) was one of the earlier attempts to analyse mergers in India. In the post 1991 period, several researchers have attempted to study mergers and acquisitions in India (Beena (1998), Roy (1999), Das (2000), Saple (2000), Basant (2000), Kumar (2000), Pawaskar (2001) and Mantravedi and Reddy (2008)).

In the recent times human capital has emerged as a dominant force in organizations and there is irrefutable evidence that the efficacy of this factor is of importance when studying the economic performance of an enterprise. It has an important role in changing or eroding the enterprise value. (Kesti, 2011; Bernardino & Miller, 2008; Seleim et. al., 2007; Bontis et. al.,1999). An established method of measuring the firm performance and effectiveness is human capital return on investment (HCROI). The study by Hitt et. al. (2000) examined the direct and moderating effects of human capital on professional service firm performance. The results showed that the leveraging of human capital had a positive effect on performance.

The influence of a firm’s HRM system on its financial performance has generated considerable interest in the academic area. It has invoked the researchers to come up with different findings that help to establish the interrelationship between HRM and finance. (Guest (1997); Chan et. al., (2004); Becker and Huselid (1998); Singh (2003); Becker and Gerhart (1996)).

When studying mergers and acquisitions, it was found that research began to focus on the human dynamics and people management issues, only in the late 1980s (Cartwright & Cooper, 1990). It is said that the “HR can make or break the Mergers and Acquisitions” (Schraeder and Self (2003)). Yet Shook and Roth (2011) found that HR practitioners were not involved in planning decisions related to downsizings, mergers and/or acquisition. So they suggested that these practitioners need to play a more active role during the planning stages to ensure that training and development supports the financial goals of these change events. To capture a more complete picture of the role of human capital intervention during the integration stage of merger and acquisition, Rizvi (2011) found a positive association between human capital indicators and organisational performances through quantitative and qualitative study of firms.

Regarding changes in wages and employment, Charles Brown and James L. Medoff (1987) carried out a comparative analysis between firms which had undergone acquisitions with those that were not involved in acquisitions. The results depicted small and sometimes positive changes in wages and employment following an acquisition. Conyon, M.J. et. al., (2004) in their study, “Do Wages Rise Or Fall Following Merger” successfully proved that wages rise following acquisition.

The empirical study conducted by Park et. al. (2002) had profound impact in the research field related to M&A in the telecom sector. They investigated how market participants react to M&A involving telecommunications companies. The evidence suggested that such activities convey bad news to the market, to the shareholder value and a cross-border deal, rather than a domestic M&A deal, was the main driver of the negative market reaction. This suggested that value creation or synergy through an M&A deal was not a warranty even though it can generate an increase in size of the firm.

Petkova, M. and Do, T.Q. (2012) explored whether the European acquirers in the telecom sector failed to deliver value to their shareholders in the period ranging from 1995 to 2005 and also discussed the possible motives behind the intentions to engage in M&A. The main inference drawn from the study was that acquisitions in general fail to create value to the shareholders, which might be due to many factors. They concluded that despite the negative evidence concerning post-acquisition performance, firms still choose to engage in acquisitions on account of external or internal motives.

Majumdar, S. K. et. al. (2009) evaluated the impact of the various mergers of the local exchange companies in the United States telecommunications industry that have taken place between 1988 and 2001 on technology investment levels among the firms. They conceived that the ‘efficiency defense’ for merger approvals did not hold and the findings call into question the validity of fundamental tenets of contemporary competition policy.

Yaylacicegi, U. (2005) explored the consequences of mergers and acquisitions in the telecommunications industry for the period 1988 to 2001 and established a significant evidence that mergers were followed by substantial deterioration in profitability and operational performance, in addition to a significant decrease in the investment on new technology.

The objective of this study is to explore the overall strategic impact of mergers and acquisitions in the telecom sector of India. We aim to comprehend whether M&A in this sector have led to the improvement in performance of the merging firms or has the performance deteriorated after the merged entity was formed. In this study, the performance of the sampled firms was examined via some human resource and financial parameters like HCROI, Compensation of Employees to PAT, EPS and Market Share. The magnitude of change from the pre to the post merger phase with respect to these aspects was studied and compared.

Based on the objectives the following hypotheses were developed:-

H1- There is no significant change on HCROI of the acquirer firms across telecom industry in India after merger and acquisition.

H2- There is no significant change on the EPS of the acquiring firms across telecom industry in India post merger and acquisition.

H3- There is no significant change in the market share of the acquiring firms across telecom industry in India after merger and acquisition.

H4- There is no significant change in the compensation to PAT ratio of the acquiring firms across telecom industry in India after merger and acquisition.

The research work is empirical in nature. The study is database oriented. Data and facts have been collected from India’s leading business and economic database and research company CMIE’s (Centre for Monitoring Indian Economy Pvt. Ltd.) database prowess 4.14. These facts have been supplemented by information from different business dailies, magazines and the websites of the Ministry of Corporate Affairs, Ministry of Statistics and Programme Implementation (MOSPI), TRAI, Press Information Bureau, Government of India and the respective companies.

The research methodology entails the following:-

From the prowess database we found that 8 BSE listed telecom companies has undergone mergers and acquisitions during the period of 2000-2010. Thus the target population of this study are these 8 telecom companies. Total 25 M&A has taken place in these companies in the said period. Out of those 25 M&A, 12 were with the subsidiaries of the acquiring companies and many had overlapping M&A in that period. Out of the 13 non-subsidiary M&As, 10 reported non-overlapping M&As during the period of our study. Those 10 M&As were selected as the subject of our study. The time frame of the study was 10 years i.e. 2000-2010.

4.1. Sample Space

We have made an attempt to trace the outcome of the M&A deals in the Indian telecom sector by examining the seven companies which are as follows:- Bharti Airtel Ltd., G T L Ltd., Idea Cellular Ltd., Mahanagar Telephone Nigam Ltd., Nettlinx Ltd. and Tata Communications Ltd. The main line of business for 28.57% of the sampled firms was cellular mobile service and also basic telephone services (28.57%). The others concentrate on wireless infrastructure (14.29%), internet service (14.29%) and communication services (14.29%).

By recording the year of incorporation, we calculated the firm age of the sampled firms. It revealed that firm age of 42.86% i.e. 3 of the firms is between 15 to 20 years at present; there are equal numbers of firms (3) in the 26 to 30 years age bracket and just 14.29% i.e. 1 of the firms is aged above 30 years.

With respect to the age of companies since merger, it was noted that presently 40% i.e. 4 of the companies is in the 11 to 15 years age bracket since the year of their mergers. Equal numbers of firms are there in the age group of 0 to 5 years and 6 to 10 years.

The sampled firms are chosen on a pan-India basis. Majority (57.14%) of the firms is concentrated in Western India.

The study is based on a short run analysis of two periods-viz three years prior to the merger and three years immediately after the merger. The secondary data which has been collected was subjected to descriptive and inferential analysis. This research work tried to test the hypotheses relating to the impact of merger and acquisition on the various parameters and thus derive at conclusion about whether the event of merger and acquisition has made an impact on the performance of these firms. The IBM software SPSS 20.0 and MS Excel were used to compute and analyse the data.

The ratios for each of the performance parameters were estimated for all the ten mergers individually. This was followed by the Shapiro-Wilk normality test. On the basis of the normality results, paired t test at 95% confidence level was carried out for dataset following normal distribution and Wilcoxon Paired Sign-Rank Test was computed for dataset not following normal distribution. This enabled us to compare means of the subject over time in the two differing situations i.e. performance before the merger and performance after the merger. t-test and Wilcoxon test were chosen because those are easy to understand and perform as well as used widely.

The following formulae have been used for computation purposes:-

HCROI:

[REVENUE-(OPERATING EXPENSES –COMPENSATION)]/COMPENSATION EARNINGS PER SHARE:

[(PROFIT AFTER TAX – PREFERENCE DIVIDEND)] / NUMBER OF SHARES MARKET SHARE:

(COMPANY’S TOTAL INCOME/ INDUSTRY’S TOTAL INCOME) X 100 TOTAL COMPENSATION TO PAT RATIO:

(COMPENSATION TO EMPLOYEES) / (PROFIT AFTER TAX)

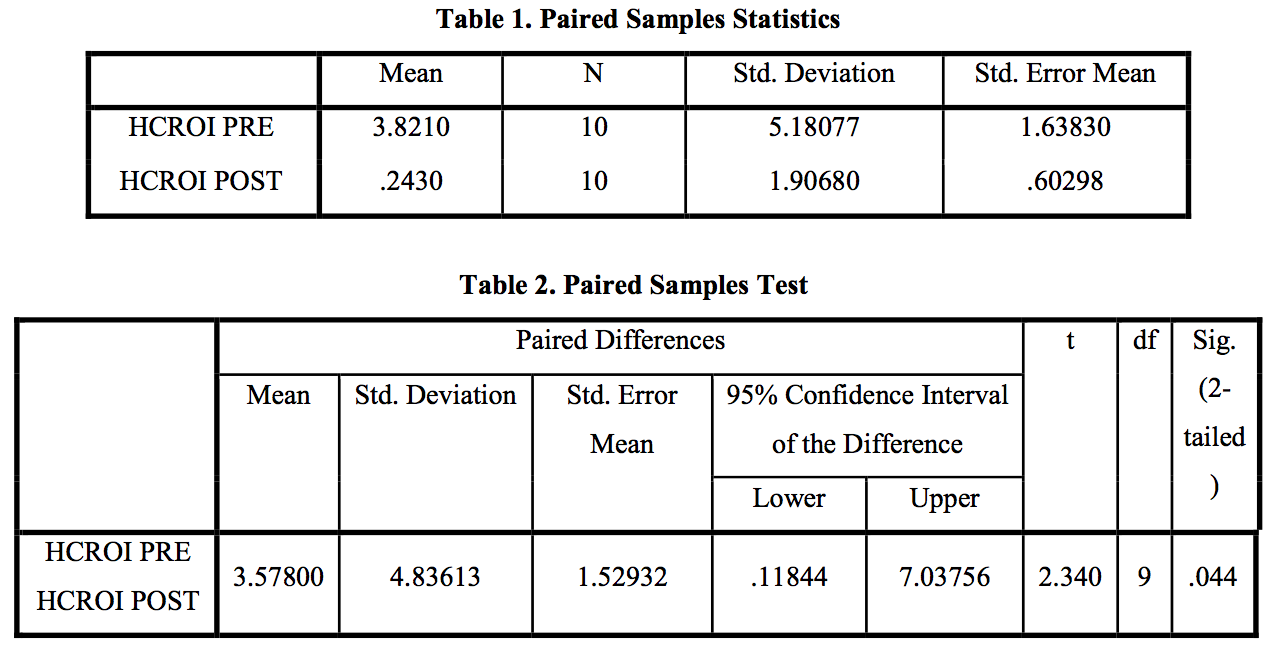

a. HCROI t Test:

Since the calculated value of t (2.340) for N=10 (as in Table II) exceeds the table value (2.262), we can reject the null hypothesis. The results are significant at 0.05 level of significance (p=0.44). This indicates that the means of the pre and post HCROI values are significantly different. From the paired samples statistics table (Table I), we observe that the pre merger HCROI mean is significantly

greater than that of the post merger period. We therefore conclude that it is more likely to have been due to some systematic and deliberate cause. If all other confounds are eliminated, this systematic cause must have been the vent of merger.

Ƞ2= (2.340)2/ [(2.340)2 + 10] = 35.38%

So 35.38% of the variability in the reduced performance in the HCROI scores can be explained by this merger. We conclude that the phenomenon of merger did not improve the HCROI of the companies in the post merger period. Previous research has proved that there is a positive association between different human capital indicators post merger and acquisition period. (Rizvi (2011); Seleim et. al. (1996); Bouillon (1996); Hitt et. al. (2000); Brown and Medoff (1987); Conyon et. al.(2000).

b. EPS t Test:

The calculated value of t for N=10 is 1.153 (as in Table IV). The result is not significant at 0.05 level of significance (p=0.279). Since the calculated value of t is lower than the table value, there is no reason to reject the null hypothesis. Hence we can say that change in the earnings per share of the companies on the post merger phase is not significant.

So 11.74 % of the variability in the abridged performance in the earnings per share scores can be explained by this merger. We deduce that the phenomenon of merger did not benefit the earnings per share of the companies in the post merger period.

Previous research has shown that the activity of mergers and acquisitions has a mixed impact on EPS and share price of enterprises post merger. (Mahesh R. and Daddikar, P. (2012); Loughran, T. et. al. (1997); Hassan, M. et. al. (2007); Andrade (1999); Tuch, C. and Sullivan, N. O. (2007); Delaney, F.T. and Wamuziri, S.C. (2004); Kumar, B. R. and Panneerselvam (2009); Al-Sharkas, A.A.(2010 and Ramakrishnan, K. (2010)).

c. Market Share t Test

The calculated value of t for N=10 is 0.699 (as in Table VI). The result is not significant at 0.05 level of significance (p=0.502). There has been no significant change in the market share of the companies post merger. We observe that the post merger market share is slightly lesser than that of the pre merger period.

Ƞ2= (0.699)2/ [(0.699)2 + 10] = 4.66%

So 4.66% of the variability in the abridged performance in the market share scores can be explained by this merger. We surmise that the phenomenon of merger did not perk up the market share of the companies in the post merger period.

Past study relating to investment bank market share and performance of acquiring firms depicted that market share was positively related to contingent fee payments charged by the banks and also to the percentage of deals completed in the past by the bank. It was unrelated to the performance of the acquirers. (Rau, P.R.(2000)).

d. Compensation of Employees to PAT Wilcoxon Test

Table 7 shows that the negative mean rank is less than the positive mean rank. This suggests that the compensation to employees to PAT ratio measure post merger is likely higher than that in the pre merger period. So we can infer that the phenomenon of merger has accentuated this performance parameter. Previous research has shown small and sometimes positive changes in wages in the post acquisition phase and others have successfully proved that wages rise following acquisition (Charles Brown and James L. Medoff (1987) and Conyon, M.J. et. al., 2004).

This paper studied four parameters which can throw light on the performance of the Indian telecom companies in the pre and post merger phases during 2000-2010. Only the HR parameter HCROI revealed a significant change in the post merger period. All the remaining three aspects selected for computing the performance divulged no significant change in the period post merger. The ratio between compensation of employees and PAT has been the only parameter where the performance has improved after the merger. Since three out of four parameters have shown no significant enhancement during the post merger phase, it may be concluded that the change in the overall performance of the seven telecom firms due to merger in the period of 2000-2010 was not of much significance.

M&A are often referred as corporate marriages and alliances. Just like all marriages are not destined for a happy relationship; similarly all the phenomena of merger are also not prolific. In fact the reverse is true majority of the time. Despite the popularity of mergers and acquisitions, evidence has shown that the majority have failed to improve performance and to achieve anticipated strategic and financial objectives set forth in the premerger planning phase. The article “Top Management Team Turnover in Mergers and Acquisitions” proved that acquisitions appear to create long-term instability in the target firm’s top management team – both incumbent and new-hire executives depart at higher rates than normal (Krug, J. and Aguilera, R., 2004). According to Cartwright and Cooper (2000) the primary reason behind such common performance failures was based on human resources factors such as culture, management, poor motivation, and loss of talent. In the Corporate Leadership Council, 2003, one of the key findings indicated that “Up to 85% of M&A failures are attributable to problems in the integration of employees and the management of cultural issues in the merger or acquisition”. In this study, it could not be ascertained from the available data whether a broad based, rigorous due diligence procedure was undertaken covering not only financial issues but also employee related issues. As a result, the merged entities might have encountered cultural problems during the integration period.

The year 2008 witnessed a financial meltdown all over the world. The global economic recession had taken its toll on the Indian economy as well. The period of our study coincides with this period of recession. It is known that an organization takes time to get acclimatized with the new work environment after a merger. Since the merger & acquisition under consideration in the study coincided with the period of recession, the newly formed entities must have experienced numerous problems. They faced difficulties in coping with the adverse macro financial situation and integrating the merged firms on the other. This in turn might have affected the overall productivity of the firm.

An economy takes time to recuperate after a financial meltdown. It is influenced by the spillover effect of the phenomenon. Spillover effect refers to a secondary effect that follows from a primary effect, and may be far removed in time or place from the event that caused the primary effect. In this study, the post merger period of the firms corresponded with the period immediately after the recession. So quite naturally, the corporate were undergoing spillover effects at that time.

The prowess database has not reported the hierarchy-wise distribution while computing the compensation of the employees. Due to this limitation, equal weightage was given to all the employees. With more detailed data on this, our study would have been more robust. Another limitation is the timeframe of the study. This study, a part of research covering a large gamut of issues, necessitated the restriction of the time period to the ten-year timeframe spanning from 2000-2010. Though the sample size of 10 finally merged or acquired pairs of firms appears to be limited, it forms the 40% of the population size (total 25 M&As). No control group was used in the study. Due to obvious constraint of unavailability of data, the target firms which had undergone mergers were not considered in the study. However this study paves a way towards further research using longer time periods and inter-sectoral studies. It also encourages future studies on several other HR and financial aspects which are influenced by the events of mergers and acquisitions.

Mergers and acquisitions, a staple in the business world, represent the consolidation of companies or assets, often aiming to achieve growth, enter new markets, or

IMAA’s 2024 Top Global M&A Deals industry coverage offers an overview of the year’s most significant M&A transactions across eight key industries. This monthly M&A

Explore the transformative journey that mergers and acquisitions activity is bringing to the sports industry. The Institute for Mergers, Acquisitions, and Alliances (IMAA) dataset on

Stay up to date with IMAA Institute company news

Trainings

© Institute for Mergers, Acquisitions and Alliances

In order to become a charterholder you need to complete one of the IMAA programs